Welcome to this shortened trading week and to Momentum Wednesday (in lieu on Monday). Markets will also be closed next Monday as well so we too will alter the timing of this report to suit.

And just to start us on a positive footing, we at Stockopedia hope that you will all have a prosperous New Year, both in wealth and good health!!!

_______________

Anecdotally it is tough to generate any clear direction at this time of year... however it can definitely play a role in maintaining the continuation of a trend.

Therefore before we commence this week’s analysis, we caution reading too much into any signals provided at this time.

But of course, investors still need to respect the broader narrative and trade accordingly. (Otherwise why bother writing this week’s edition?)

S&P500

The S&P500 had its third negative week in a row. Further entrenching it within the down channel that has formed from the peak a little under 12 months ago now.

S&P500 Weekly Chart

2022 will likely be recorded as a down year for the S&P500, its first since 2018. The good news, barring disaster, is that it won’t be as bad as 2008 (GFC related) which was our third worst annual performance for the S&P500 on record.

S&P500 Performance since 1928 Source: MacroTrends.net

Bringing it back to the present day, Despite the downward move, we are still above the range of 3700 - 3740 meaning there is hope. We flirted with the top of the range on Friday which you can see on the chart. But for now we are holding.

Even lasts night’s fall (27/12) of 15.58 points to 3829.24 was not enough to break the line yet.

As a reminder, a break below this range will likely see a test of the downward part of the channel of between 3300-3400.

The lead up to the New Years trading Holiday in the US will likely be more keenly watched than usual, given where the index sits.

S&P/ASX200

Likewise, we too experienced our third consecutive down week for the S&P/ASX200

S&P/ASX200…

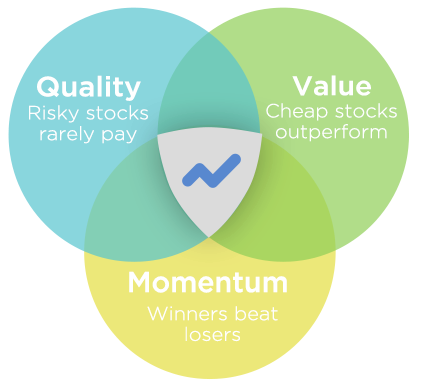

Where better to start than by leaning heavily on our

Where better to start than by leaning heavily on our