Let me start with a question - which of the following will perform best:

1. A careful selected portfolio of 20 stocks?

OR

2. A portfolio of 20 stocks that are chosen at random but with strict money management rules?

I am a value orientated investor but I would suggest that the performance of portfolio 2 might surprise many people. A lot of modern investment management is focussed on the process of stock analysis and very little is on money management.

So what do I mean by 'money management'?

Money management is a set of rules to systematically size positions, control risk and put on positions and take them off in a structured, systematic and planned manner.

Often the best way to start a discussion is by discussing what one does - so here goes.

1. Stock selection

The mechanics of how to select a stock are varied but generally fall into 'story lovers', ' technical analysis', 'fundamental analysis' etc. The key point is recognising what type of investment it is and WRITING DOWN your thesis.

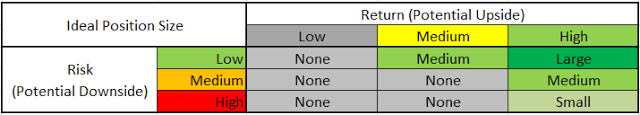

2. Work out how much you are prepared to risk

I am generally happy to risk 10 - 250 bps per position. Others will have different mileage. For me what matters is (i) how much work I have done (ii) how much 'edge' I have (iii) how does the risk compare with the reward.

So I do not look at risk in isolation but also in comparison to the reward. (Aside: In Van Tharp speak I look at the expectancy - except I look at the probability weighted expectancy).

Again I write down my estimates.

3. Work out a reasonable place to have a stop

There are lots of different methods people use to place stops. I tend to use a 'soft stop' and a 'hard stop'. The soft stop is placed at a level where I will question my hypothesis. It might be a couple of standard deviations from the current price or it might be at a clear level (eg for a company that has recently IPOed I know other investors will get nervous if it falls back down to the IPO price) or it might be based on a seasonal or technical issue.

I am sure the fundamental investors on this site will 'poo-poo' the idea of a stop loss. I generally spend a long time researching stocks - but I am also grey haired enough to know that sometimes I get things wrong. Indeed one of…