(Please note that I have a long position in Rightmove (LON:RMV))

Have you ever heard of a monopsony? It’s one of those rare words which you might learn for an exam, and then never think about again.

It means a market where there is only one buyer of a product or service. This makes it the opposite of a monopoly, which is a market where there is only seller. Monopolies are in general considered to be undesirable, and monopsonies are their mirror image.

A monopsony sometimes arises in the labour market, where a person’s skills are specialised to such an extent that their labour is only very useful to one firm. That one firm is willing to keep “buying” those skills (i.e. hiring that individual), but the skills aren’t of much use to anybody else.

In reality, most skills are transferable. But for example, when someone spends their entire working life at a single company, their understanding of that organisation and its culture reaches an extraordinary level, and their skills have probably become specialised to that organisation.

The same phenomenon can arise in particular locations where there is only one large employer. This employer is the main “buyer” of labour in that area, i.e. the monopsonist. Workers who don’t want to be employed at that firm have limited options: their main alternative is to leave town, and move somewhere else.

For this example we assume that it’s not possible, or too difficult, to start a rival firm which could compete for labour in that town. If the monopsonist is the owner of a coal mine, and there are no other mining deposits in the area, then this might be a realistic assumption.

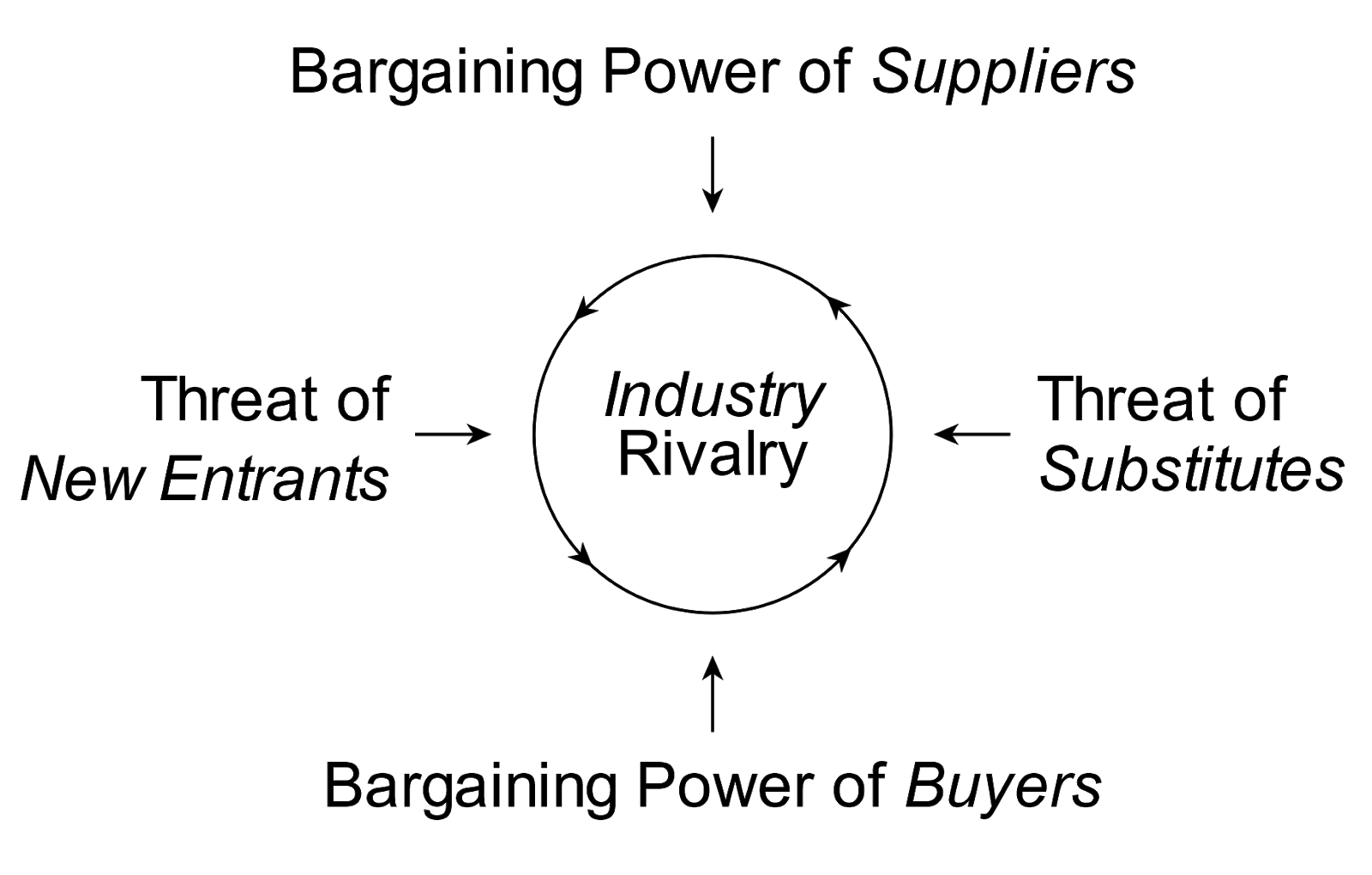

Porter’s 5 Forces – Wikipedia.

The concepts of “monopoly” and “monopsony” fit into the classic framework within which competition is analysed, known as Porter’s 5 Forces.

- Monopoly (meaning “single seller”) occurs when the bargaining power of suppliers is at an extreme level.

Monopsony (meaning “single buyer”) occurs when the bargaining power of customers is at an extreme level.

Economists will tell you that in a state of perfect competition, where there are no barriers to entry, there can be no such thing as an “economic profit”. This means that all firms would earn their cost of capital, and no more. This theory leads to the…