You may remember our 2023 analysis of the top ten UK multibaggers of the last decade. Now there’s a fresh, data-heavy paper - *The Alchemy of Multibagger Stocks* by Anna Yartseva - a Birmingham City University academic - that analyses US stocks across many of the same dimensions.

In summary, the US evidence marries up very well with what we saw in the UK.

What the US study says

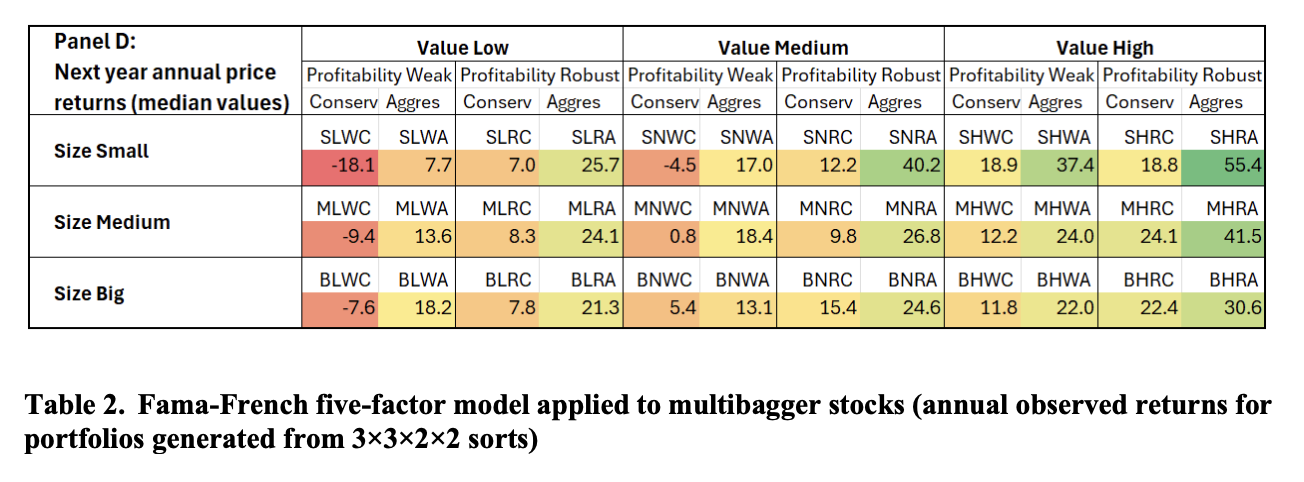

Yartseva built up a 2009–2024 dataset of 464 ten-baggers (stocks that rose greater than 10x and were still greater than 10x at the end of the period). She then tested what actually drove those returns by creating 36 portfolios split by size, value, profitability and investment characteristics.

Key insights

- The best performing multibaggers started small, with an average market cap $348m in 2009.

- Multibaggers, regardless of starting size, benefited from low valuations (the average forecast P/E was only 11x at the start).

- Through their runs, the average multibagger compounded its growth at high rates: revenue at an 11% annualised rate, operating profit at 17%, and EPS at 20%.

- Across the set small size, relative cheapness, high profitability, and aggressive capital investment led to stronger returns.

- The paper also re-states our multibagger equation : EPS growth + P/E Multiple expansion.

The chart below shows the 464 multibaggers split into 36 buckets by their characteristics and their “next year price returns” accordingly. It’s worth trying to understand the dimensions. On the right are cheap stocks (Value High), with splits across robust or weak profitability and conservative or aggressive investment.

You can see at the far right that the very best returns were in undervalued small caps with high profitability and aggressive investment.

A simple guardrail emerges. Be very wary when a multibagger you own shows lower profitability and stops investing, especially if it’s at a moderate or premium valuation. That’s when drawdowns are going to hurt.

How this echoes our UK top-ten work

In our UK study and masterclasses we emphasised five “financial engines” for multibaggers:

- Sales growth runway - winners found new geographies, products or channels (e.g., Games Workshop’s international and licensing push).

- Operating leverage - i.e. revenues up, profits up faster. We showed how many of the UK top ten expanded operating margins through their run.

- High and rising ROCE - the true engine of compounding: multibaggers reinvested…