Card Factory - Lowest cost Producer and Vertically integrated Retailer.

May 21st 2021 up-date

Card Factory (LON:CARD) (buy at 38p, and still hold at 73p)- The refinancing is completed, Card Factory shops are re-opened and return to level pre-covid sales level, and the equity fund raised in view. All three elements are in place for the business to return to good health. https://www.stockopedia.com/sh... link the new release.

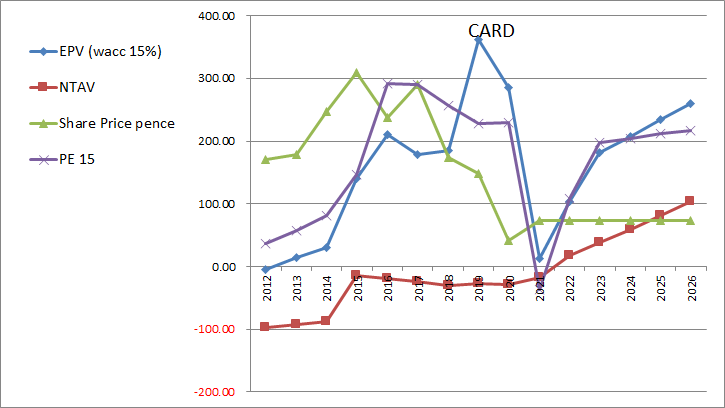

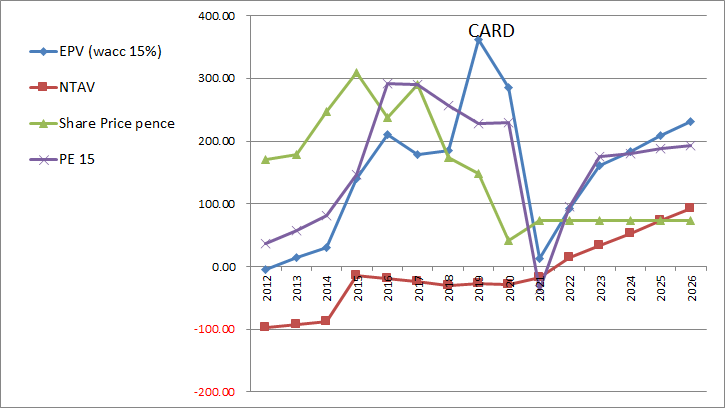

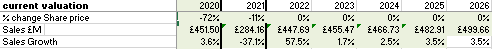

To understand why this business is like to do well it important to understand the Free cash the company is able to generate. I've revised my model with the new equity raise at 60p and 40p below.

Sales Estimate FY21-FY26

Evaluation model at 60p fundraise (117m new share in issue)

Evaluation model at 40p fundraise (175m new share in issue)

150p above share price looks very feasible regardless of the level of dilution. I hope retail shareholders get to participate in the fundraiser.

I am happy to continue to hold my position in the stock. I really must state please do your own research and evaluation of prospects here before making your own decision.

BSV

1 April 2021 UP-DATE

Card Factory (LON:CARD) (Hold at 73p)- banks continue to wavier debt pile, is a welcome piece of news. I still expect the company to want to raise funds and hopeful this will be done at a higher share price supporting the valuation below further.

https://www.stockopedia.com/sh...

DYOR

BSV

15 Jan 2021

Card Factory (LON:CARD) Had a year low of 25p during 2020 having declined 72% by year-end and looks good value at 38p today.

I was encouraged by the sales numbers (£284M FY 21) during the Covid-19 period and cash how cash has been conserved (probably due to government help ).

After 5 years of poor share price performance (Share price moving from 327p to 38p today) valuations look extremely cheap. With Covid-19 vaccines rollouts in the UK, a full recovery seems on the cards by year-end 2021. Add this with the growth engines of online sales and partner sales the future looks bright ex-covid 19. If free cash can return to previous levels this is a very profitable business.

Sales Estimate FY21-FY26

Unlock the rest of this article with a 14 day trial

Already have an account?

Login here