CMC Markets - Profit warning in quiet market conditions

Up-date 2nd Sept 2021.

Cmc Markets (LON:CMCX) hit a new low at 74p in 2019. (lowest buy price 85p, additional buys at 125p, 175p , 363p, 461p ). ( I hold a long position)

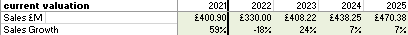

Cmc Markets (LON:CMCX) issued a profit warning on quieter market conditions, income expectations now expected to fall from £330m to £250-280M. That is quite a reduction within 1 month of Q1's trading update. This takes all my forecasts down considerably. seel below

https://www.stockopedia.com/sh...

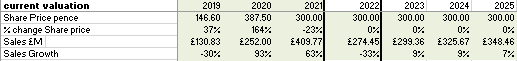

Sales Estimates FY21-25

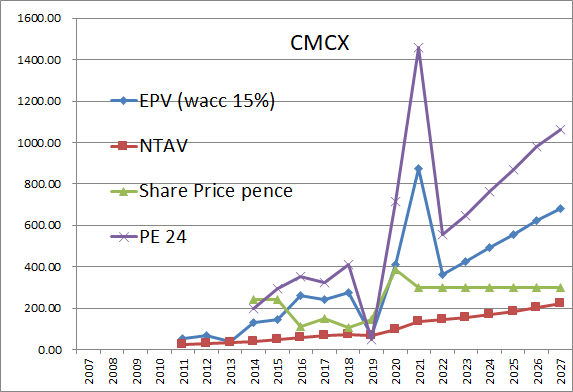

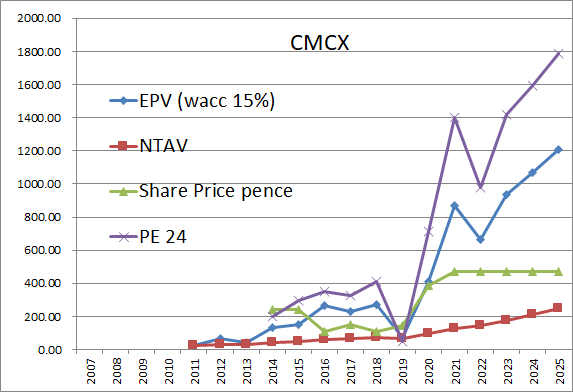

Evaluation model suggests 400p valuation for 2021 end, (1000p upper end target for 2025). See the graph below)

For my own portfolio, I decided to take some profits and close down all my positions in my spread betting account. I still hold a longer-term holding in my ISA which I hold for the long term as a hedge for choppy markets.

BSV

CMC Markets - Sustained growth for longer

Up-date 25th March 2020

Cmc Markets (LON:CMCX) hit a new low at 74p in 2019. (lowest buy price 85p, additional buys at 125p, 175p , 363p, 461p ). ( I hold a long position)

Forecast and valuations upwards, as Q4 up-date reports in excess of end of expectations.

( Net operating income of £376.6 million, ranging from £370.2 million to £387.5 million. Profit Before Tax of £197.2 million, ranging from £191.3 million to £206.3 million).

The link provided to the news release.

https://www.stockopedia.com/sh...

Cmc Markets (LON:CMCX) say operation income in excess of £399M

Sales Estimates FY21-25

Evaluation model suggests 800p valuation for 2021, (1850p upper end target for 2025). See the graph below

up-date 8th OCT 2020

Cmc Markets (LON:CMCX) hit a new low at 74p in 2019. (lowest buy price 85p, additional buys at 125p, 175p , 363p ). ( I hold a long position)

Cmc Markets (LON:CMCX) has come out with half-year results today, and make excellent reading;

- CFD net trading revenue of approximately GBP200 million (H1 2020: GBP85 million)

- Group's stockbroking net revenue is expected to increase to approximately GBP26 million for H1 2021 (H1 2020: GBP14 million)

- Following the strong performance in H1 2021, the Board…