30th DEC 2022

Creightons -mitigation of Covid related hygiene Sales

Creightons (LON:CRL) released a half-year result today, demonstrating a return to its traditional growth profile. The company states 'Core sales have increased by GBP8.37m (40.2%) which has substantially replaced the Covid-19 related hygiene sales which were a once-off feature of the previous half-year. Like many company's it has invested in working capital to overcome supplier chain delays.

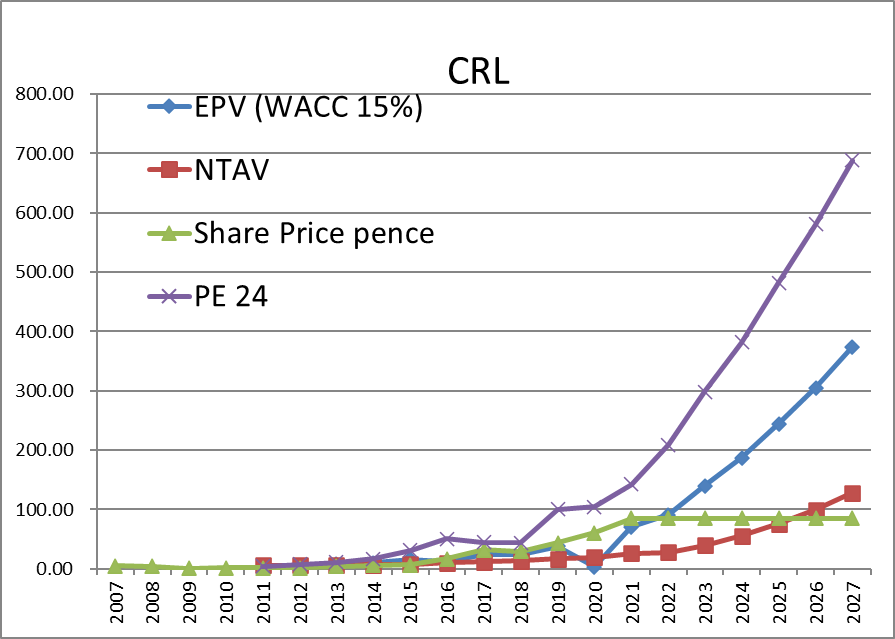

It is one of a few companies I'd be willing to pay up for the growth. a PE of 20-24 seems closer to fair value.

The company also successfully completed two acquisitions in the period - Emma Hardie and Brodie & Stone - which will further strengthen the underlying branded business and should add substantially to underlying profitability.

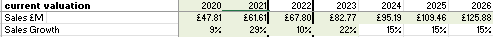

Anyway I have updated my forecast. (see below)

Sales Estimate 2022-2026

My valuation model suggests plenty of upsides. (see below)

My fair valuation for year-end is close to 202p for year-end 2020 and could be as high as 661p by 2026

As always please DYOR and don't trust vlogs and blogs including this one.

BSV

6th Aug 2021

Creightons -Emma Hardie Acquisition.

Creightons (LON:CRL) released a video on the Emma Hardie acquisition. The link is provided below.

https://bit.ly/CRL_EmmaHardie_acquisition

The main takeaways I took is that,

- Emma Hardie, with cost and market synergies, should see sales of £5M with £1M EBITDA in the near term, with plenty of growth for the future also. It feels like a well-thought acquisition by a team that understands the market and opportunity very well.

- Significant confidence in reach £100M top-line revenue by 2024/25, £30M organic growth, £20M M&A, and margins to improve with top-line growth.

Without knowing the specifics of the Emma Hardie business it is difficult to know if a fair price is paid. I am assured, Creightons (LON:CRL) has brought a business with excellent growth, high margins, and access to new distributions channels, with Creightons (LON:CRL) have the resources to make the most of the opportunities available.

As always DYOR, watch the video and comes to your own conclusion.

BSV

21st JUL 2021