Xpediator - Ahead of expectations and plenty of growth runway

12 Apr 2021

Up-date model 12th Apr 2021

Xpediator (LON:XPD) hit a new low at 15p in March of 2020. (lowest buy price 22p, additional buys at 32p, additional buys 49p, 57p ). ( I hold a long position)

Sales grew at 3.7% and actual reported profit before tax of £3.9m (2019: £2.2m) in a difficult year. First-quarter trading results are positive and ahead of management expectations

See the link for more information.

https://www.stockopedia.com/sh...

The company also had a result call which more details linked included below.

https://www.investormeetcompan...

Gross margins improved from 24.6% to 25.1%, with the company suggested further improvement as site consolidation and integration continues. XPD expects to return to acquisitions in the second half of 2021. Covid unwinding should improve top-line growth and profit. Brexit has increased costs but the company has beable to pass these on to customers.

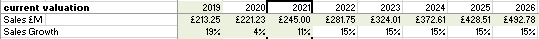

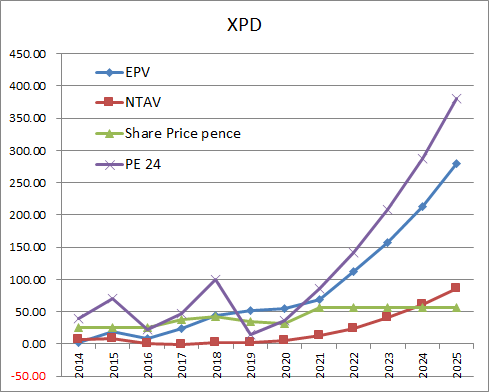

My Estimates are updated below based on today's news.

Sales Estimates FY20 to FY26

The evaluation model suggests 67-86p valuation for 2021, and 330-380p target for 2025. See the graph below

As always DYOR,

BSV

Xpediator - Ahead of expectations

29th Jan 2021

Xpediator (LON:XPD) hit a new low at 15p in March of 2020. (lowest buy price 22p, additional buys at 32p ). ( I hold a long position)

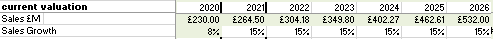

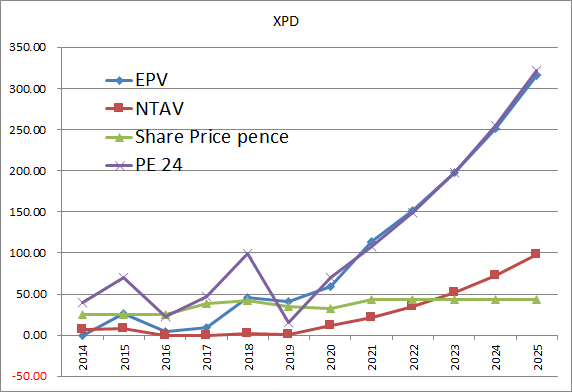

Xpediator (LON:XPD) reported today adjusted PBT will be £7.2m, which much high than expected (this 300% plus growth in EPS), due to higher demand in Nov and Dec. With an energetic CEO determined to grow Sales to £500M over the next few years top line and EPS growth look set to continue.

Sales Estimates FY20 to FY26

Evaluation model suggests 114p valuation for 2021, 300p target for 2025). See the graph below

DYOR

BSV