The gold price continues to look strong. Central banks have been gobbling up the yellow metal but all the while supply is dwindling.

In fact the World Gold Council reports that central banks have bought 374 tonnes of gold this year alone – a post-war record. Central bank demand is just one part of the puzzle though.

We explored other attractive gold price dynamics here but there is unfinished business. Somewhere out there is probably a well-placed, healthy, profitable gold miner offering material upside for shareholders. I want to find that stock.

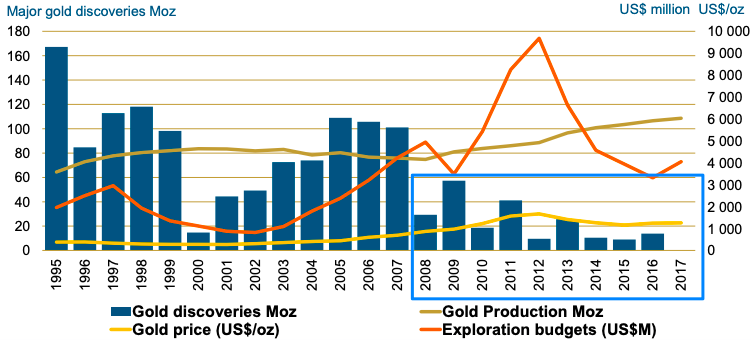

It looks like it’s getting harder to find new reserves of the yellow metal just as demand has ramped up. Despite increases in exploration budgets, no major discoveries have been made in almost a decade.

This slide from a recent Barrick Gold presentation shows a marked decline in major gold discoveries:

The world might strike gold once again, but the fact remains we have built up a decade or so of low supply. Another dynamic that points towards the price of gold rising.

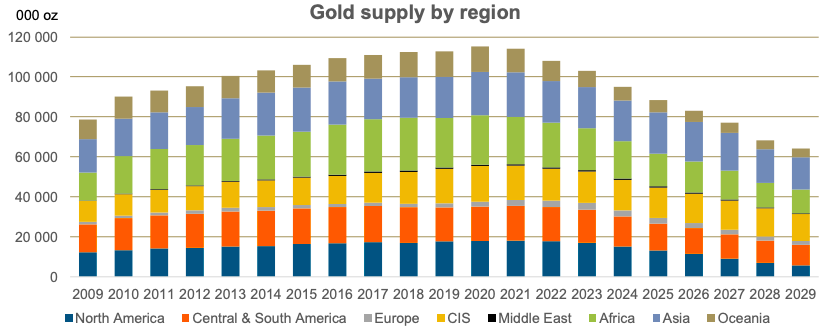

Gold miners have been increasing production despite the dearth of discoveries, meaning that they are eating into their own reserves. Forecasts suggest supply is going to shrink substantially over the next decade - so those that can continue to produce are well placed to grow profits.

Below I take a look at two cheap gold miners that might fit this profile: Anglo Asian Mining (LON:AAZ) and Petropavlovsk (LON:POG) .

There’s a lot to cover, and I’ve still only just scratched the surface of what’s happening at Petropavlovsk in particular. There are other names to consider later, though, including:

- Highland Gold,

- Caledonia Mining, and

- Shanta Gold

There may be some I’ve missed off the list. If you think of any just say and I’ll make a note.

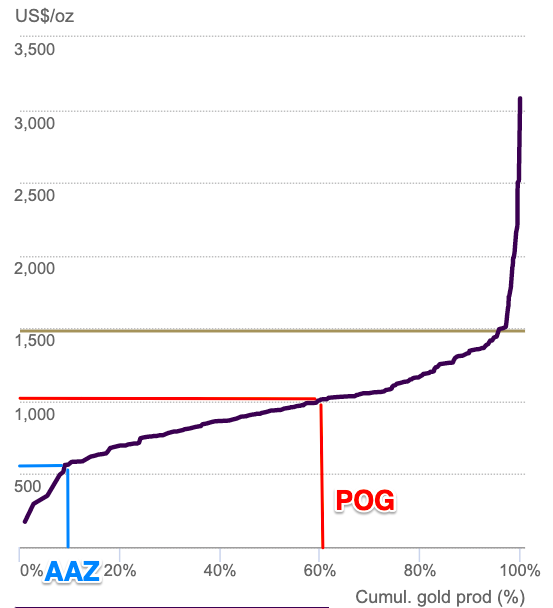

I’ll focus on AAZ and POG for now. This chart shows the all-in sustaining cost (AISC) curve of the global gold industry. I’ve pointed to where each miner figures (roughly) on that curve.

Note that the attractive part of POG has less to do with today’s AISC and more to do with future potential. AAZ, on the other hand, clearly has much more immediate economic attractions.

.jpg)