Reposted from S&P indices.

"EXECUTIVE SUMMARY

With a wealth of smart beta indices to choose from, market participants may find it difficult to decide when each factor-based strategy is best suited to deliver returns. Is it wise to rely solely on the performance of one factor? If not, what multi-factor approaches could be considered and how effective are they?"

http://us.spindices.com/indexology/smart-beta/the-merits-and-methods-of-multi-factor-investing?utm_source=Daily+AR&utm_campaign=3ed17473e6-RSS_EMAIL_CAMPAIGN&utm_medium=email&utm_term=0_c08a59015d-3ed17473e6-140327645

@underscored - it's quite flattering that S&P have copied our QVM Venn. :-D - they aren't the only ones to have done so. We are well ahead of the curve here.

Frankly though (personally) I wouldn't touch any of these packaged ETFs. They are all designed for scale. That means the best QVM opportunities in small caps (that the Stockopedia community are so adept at taking advantage of) are normally massively underweight in packaged scale ETF products.

My view is that factor ETFs are for the birds.

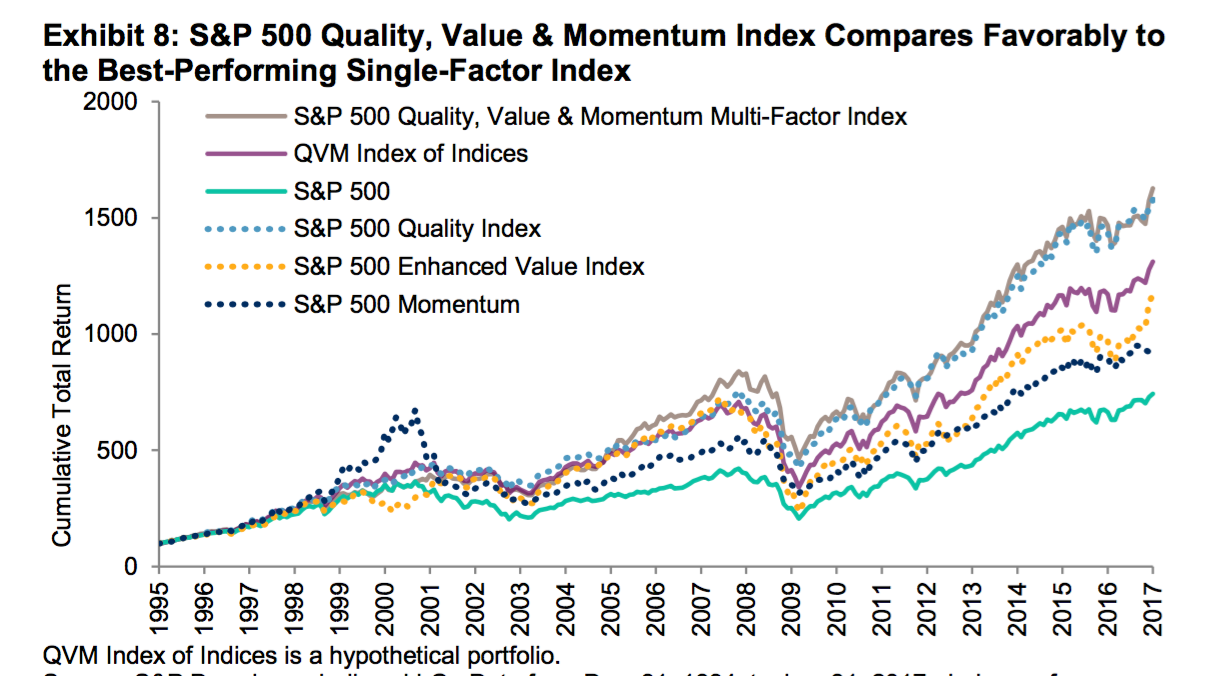

This though is a nice chart that shows the long term outperformance of these factors.