Last week’s Mello London 2025 conference provided a welcome opportunity to catch up with my fellow Stockopedia scribes and the wider private investor community.

As always, there was also a well-curated selection of companies presenting and a chance to gain valuable real-world insights from a range of accomplished investors.

Here are two of my highlights from Mello.

Who will buy the shares from you?

One of the more thought-provoking presentations I saw was from fund manager Alyx Wood of Kernow Asset Management. Kernow is a small fund focused on contrarian opportunities, where there’s the prospect of a catalyst to realise fair value.

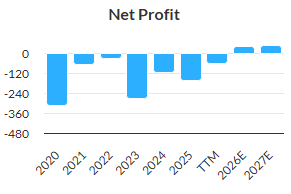

Wood’s presentation was about Saga (LON:SAGA), which is currently one of the larger positions in his fund. In brief, his thesis was that this was a good business that had been mismanaged and had then had to face the additional complications of Covid.

Now that the company is back under the leadership of the founding De Haan family, Wood believes the grey pound – the outsized purchasing power of the over-50s – will prove sticky and resilient, allowing Saga to rebuild its profits.

In parallel, the company’s decision to sell its underwriting business should reduce capital requirements, improve profitability and aid a continuing reduction in net debt.

My key takeaway: what’s the catalyst?

I think Saga is an interesting investment idea that could be worth further research. But the main takeaway for me was the process Wood described for how and why he expected the re-rating of Saga stock to take place.

When analysing turnaround and value situations, it’s easy to focus on the fundamentals and value proposition without asking what actually needs to happen to trigger a re-rating. In short, we need to ask who the marginal buyer might be.

Share prices only rise when buyers outnumber sellers. While private investors may be the marginal buyers for very small companies, institutional buying is needed to drive larger businesses to significantly higher valuations.

Wood’s focus on catalysts makes this process explicit. Among the factors he highlighted were having line-of-sight to leverage falling below 4.0x EBITDA and Saga’s expected return to profit in FY26.

Looking beyond this, he suggested that Saga was likely to resume dividend payouts when possible. At that point, he…