Pausing for Breath?

Key macro/market trends to watch:

- Economic data can only get better: For now

- A pause in stock market uptrends: Stock markets have not yet exceeded their early June highs

- Commodities: Central bank liquidity should also help commodities

- Leading regions: Russia, China A-Shares

- Leading themes: Videogames and eSports, Cloud Computing, Biotech

- Risks: Worries over a 2nd wave of infections: Particularly in the US

The data is (obviously) looking better

This should be obvious – after all, we have just suffered what the UK Chancellor of the Exchequer Rishi Sunak called “the greatest recession in 300 years”!

After an economic collapse of such epic proportions and in record time, the end of lockdowns were always sure to herald very sharp rebounds in economic data readings from the depths of depression.

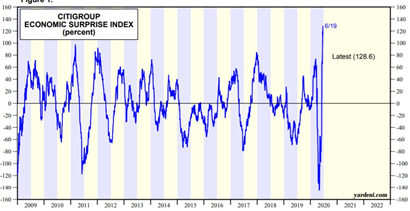

And that is exactly what we are starting to see, judging by the enormous rebound in the US economic surprise index (Chart 1):

Chart 1: A historic rebound in US economic data follows a historic collapse

This should not surprise anyone, given the speed and scale of the response by both governments and central banks to the sudden stop in the global economy since March. They are throwing all manner of economy-boosting policies in an effort to shock the global economy back into life.

The real question now is simply: how long are they going to continue this massive stimulus effort? My guess is for quite a while longer, until they are certain that their economies are back to growth and they see unemployment falling to more acceptable levels once again. This is pretty much what the US Federal Reserve chairman Jerome Powell has committed to do – to continue to help the US economy until unemployment and inflation are back to more “normalised” levels.

Ultimately, it is this gargantuan effort that is pumping liquidity into world financial markets, lifting all assets including government and corporate bonds, and of course stocks too.

And yet, stock markets are not making new highs

This last week has been one of a rebound, but really a continued pause for breath after the rally from the March lows. Despite the strength of the US stock market, the MSCI World index remains 6% down from its start-2020 level (in US dollars). Nevertheless, the FTSE continues to trail far behind global stocks, held back by its over-exposure…