Just a market consolidation or the end of a bear market rally?

That is the question!

Chart 1: S&P 500 continued to fall last week

So the majority of institutional investors remain convinced that this was a bear market rally, so right now they would be looking for a fall in a resumption of the February-March bear market trend. But when the majority of investors are positioned for a market move, that suggests that what you think will happen is actually quite unlikely to take place.

So yes we all know about the rising wave of COVID infections in US southern states like Florida and Texas. But will this really be enough to derail the US economy and global markets? I am not so sure...

We could well be in a period of market consolidation after what was a big rally from late March to early June. I would expect investors who have missed out on this market rally through their very cautious stances to be tempted to "buy the dip". If enough investors do that, then this may well end up simply being a "bull flag" formation, effectively a pauise in a longer market uptrend.

If we look away from US stocks to European or Asian stocks, we see a far less bearish picture:

Chart 2: Euro STOXX 50 (SX5E) pauses for breath

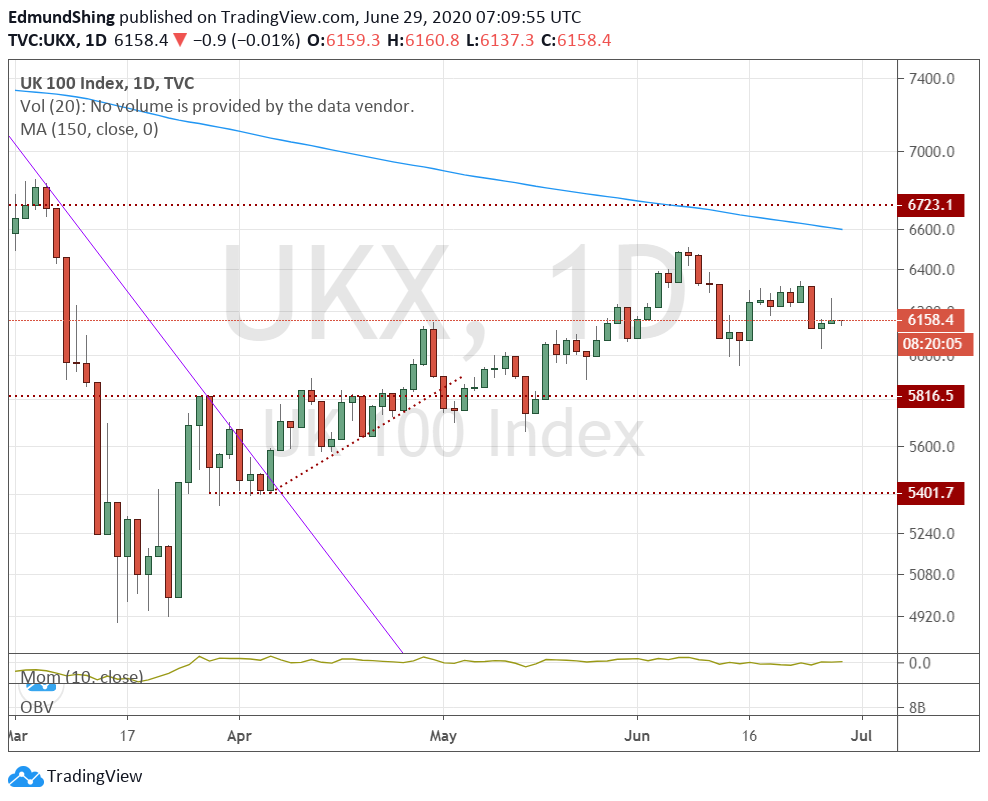

Chart 3: Ditto for the FTSE 100

Chart 4: Japanese Nikkei 225

Chart 5: Chinese Shanghai Composite remains solidly in an uptrend

So yes of course, the world tends to follow the US stock market trend as it represents today nearly 50% of the MSCI World index. But in this case, I would not rush to be too bearish too quickly, judging by these other charts.

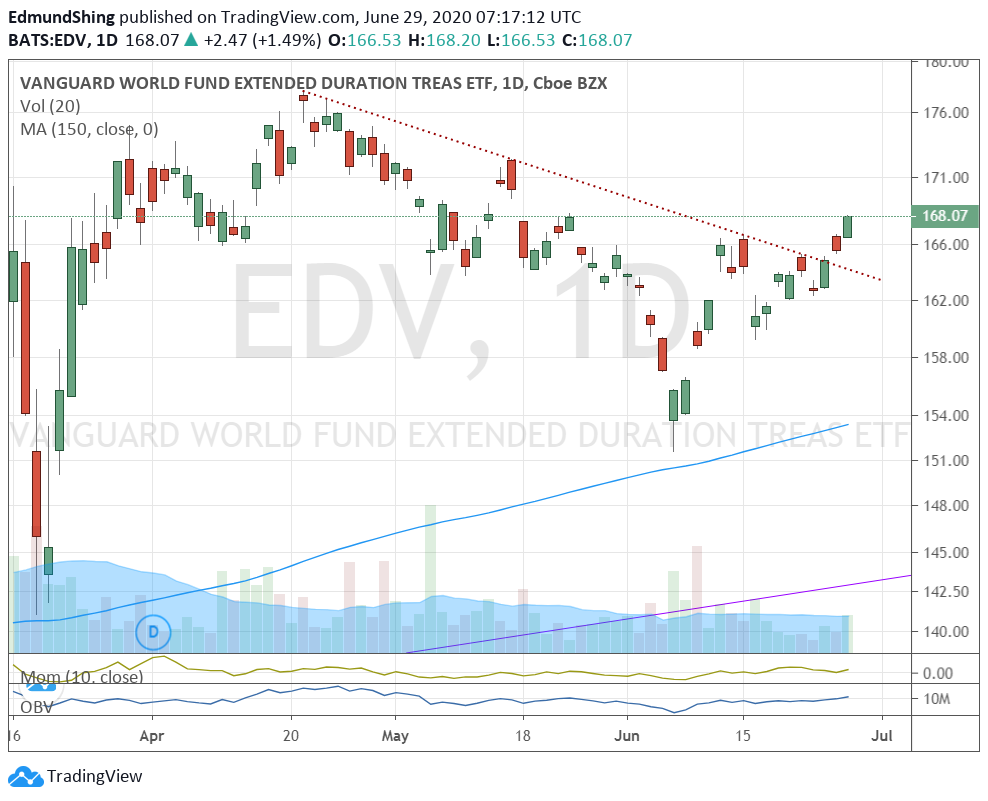

US Bonds looking Bullish

While US equities fall, US government bonds (Treasuries) look bullish. Just see how this Vanguard long-term treasury ETF (EDV) has broken out of a downwards consolidation trend into a new push higher...

Chart 6: US Treasuries turning more bullish

So some safe haven asset classes like long-term government bonds are certainly attracting admirers now, as investors become more cautious.