1. Stock markets end in the red for January

What happened to FOMO (Fear Of Missing Out)? The dominant theme of the last quarter of 2019 has evaporated over the second half of January, as multiplying fears over the spread of 2019-nCoV (coronavirus) drove global stock markets to a down month for January

Indeed, of the major Western stock markets, the UK FTSE 100 did the worst at -4% over the month, while the Eurozone lost 3% and the US S&P 500 only 1%.

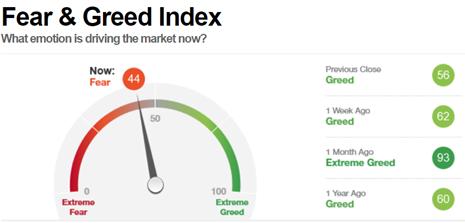

From CNN’s Fear & Greed index, we can see that the tone of the market has shifted well away from the extreme greed level touched at the end of last year, to a moderate level of fear today.

In terms of timing, this 44 Fear & Greed reading is not yet low enough to suggest a contrarian reversal to the upside is upon us. We may need to approach the extreme fear level for that to become a high-probability outcome.

2. Coronavirus facts and impact on China

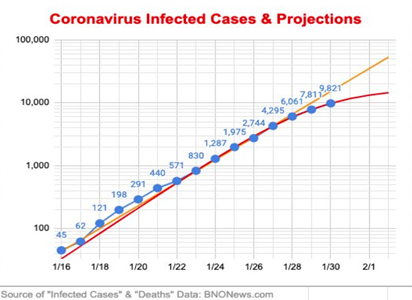

While it is difficult to pin down precise facts as far as 2019-nCoV is concerned, one fact that we can note is that the coronavirus is perhaps no longer following a precise geometric path in terms of number of infected cases. Of course, we will require several days more data to confirm this, but that already is one glimmer of hope.

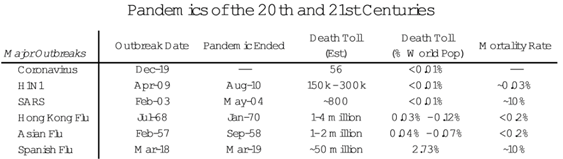

Secondly, putting 2019-nCoV in perspective, we can look at this table from Bridgewater Associates that looks at the statistics of 20th and 201st century pandemics. I was personally surprised to discover how severe the H1N1 swine virus outbreak had been back in 2009-10.

Source: Bridgewater via Linkedin

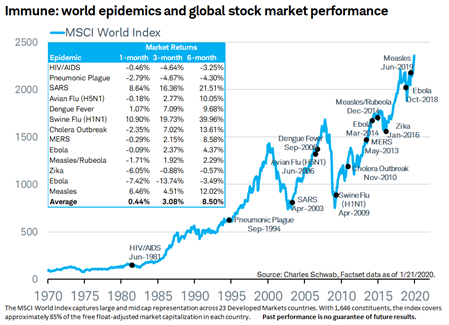

According to Dow Jones Market Data, there have been no cases in the last 40 years where the US S&P 500 index has fallen 6 months after an epidemic outbreak, with the US stock market flat or higher over 6 and 12 months following the outbreak of epidemics in each of 12 cases.

Looking below at the table of performance of the MSCI World index following epidemic outbreaks, related stock market falls have rarely lasted more than 3 months historically.

…