Each quarter I review the UKVI model portfolio to make sure it's doing what it's supposed to be doing, or to give an explanation if it isn't.

But before I get into the gritty details of whether the portfolio is up or down I'd like to draw your attention to some other things that matter just as much as raw performance numbers.

Investment goals

To hit a target you first must have a target, so the first thing to review is the investment goals by which I define success. There are four basic investment goals for this model portfolio:

- High yield – Higher than the FTSE All-Share at all times

- High relative return – Higher total return than the FTSE All-Share over any 5-year period

- High absolute return – Total returns of more than 5% after inflation over any 5-year period

- Low risk – Lower than the FTSE All-Share (measured using volatility and drawdown)

Investment strategy

That's where I want to portfolio to go, and here's a quick overview of the investment strategy I'm using to take it there:

- Buy a diversified group:

- Of good companies:

- At attractive valuations:

- Hold for the long-term:

- Target an average holding period of 5 years

- But sell occasionally to reduce risk and lock in capital gains:

There is a bit more to it than that of course, but that's the basic picture.

Performance review

As you probably know, 2015 started with a bang. After 2014, where the UK large-cap market more or less went nowhere, 2015 has seen the FTSE All-Share increase by more than 6% in just the first quarter.

The more familiar FTSE 100 has gone from 6,500 at the start of the year to 7,100 today, blasting through both new highs and the seemingly insurmountable 7,000 barrier along the way.

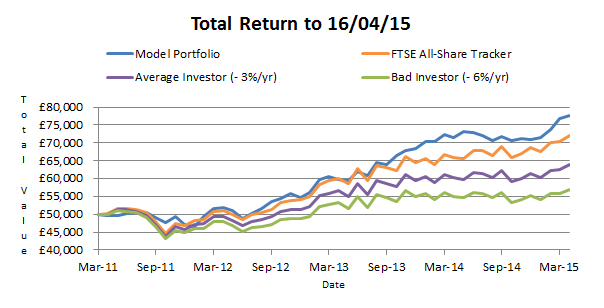

However, I don't have any short-term return goals so I don't generally think about performance over such a short period of time. Instead I prefer to concentrate on how the model portfolio had done over the past few years relative to its FTSE All-Share benchmark.

Today the model portfolio stands at £77,760, some £5,500 ahead of its FTSE All-Share benchmark, which now has a value of £72,060. Note that these results include the negative impact of broker fees and stamp duty.

So how has the portfolio done in…