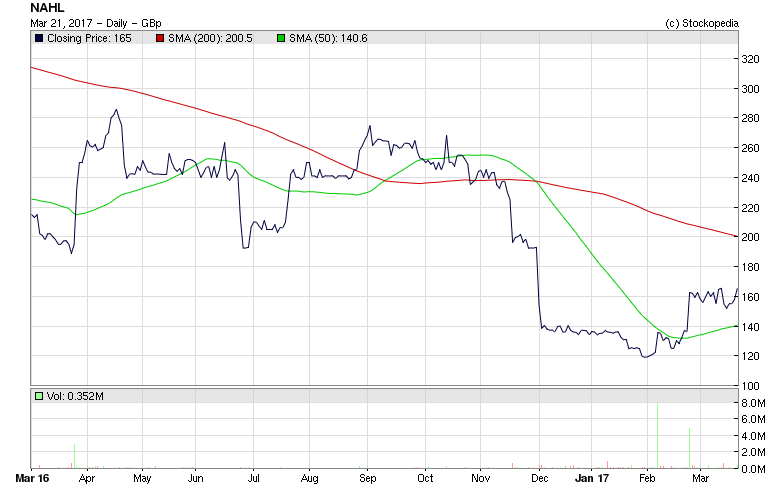

NAHL (LON:NAH)

Market Cap £82.7m

Share Price 165p Bid/Offer 163p - 165p Normal Market Size 1,500

About NAHL group plc

NAHL Group plc is an industry-leading outsourced marketing services provider and online specialist. The Group has been operating for over 20 years and now has three divisions which operate within the consumer legal services market - National Accident Helpline (NAH), Fitzalan Partners (Fitzalan) and Bush & Company.

Results for the full year were very much in line with market expectations. The share price is only slightly up since the results. Here is the RNS link for the results.

Full Year Trading Results, March 21st 2017

Future Revenue Stream

The Critical Care and Residential Property divisions revenue are expected to remain about the same over the next two years. I would anticipate this revenue to be slightly less given last year's minor percentage falls. The most surprising element is that the Personal Injury division while expected to be static in 2017 will increase by 17% year on year for 2018 and 2019.

Breakdown of NAHL's Revenue and Profitability in 2016 for the three divisions

Revenue EBIT

Personal Injury 30m 14.0m

Critical Care 10m 3.8m

Residential Property 9m 1.4m

Legislative Changes

The changes in legislation for personal injury cases has certainly unnerved investors where limits in the small claims courts has been raised and other limits for whip lash injuries have set the amount claimable a lot smaller. Read The Guardian Report and Legalfutures coverage . Although not due to come into effect until Oct 1st 2018, the share price in anticipation has taken a hammering.

Future Profitability

The company's new strategy of funding personal injury cases will tie up capital. Profits from that funding means deferred revenue and and a move towards a profit sharing model. These cases may not be settled until a year or so later. Obviously, there must be additional profit potential from funding such cases as well as risk.

I would expect the company to do some more strategic acquisition in related areas. This could be funded by further debt increases or raising additional finance as the company debt position moves from £8.2 million up to £20 million over the next two years. This is presumably due to financial funding arrangements for cases.