When the NAPS Portfolio started, way back in 2015, I had no idea that by the end of the year 19 out or 20 stocks would be winners, and the portfolio would have risen 42%.

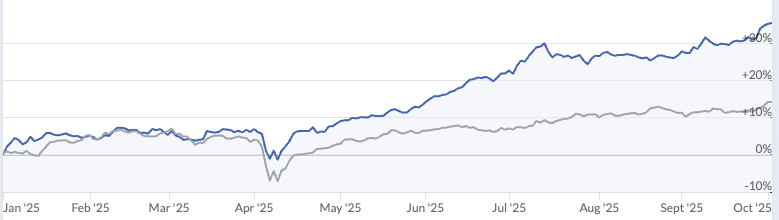

2015 turned out to be one of the best ever years for the NAPS, but I’m starting to wonder whether 2025 might match it.

The first half of the year has been nothing short of stunning.

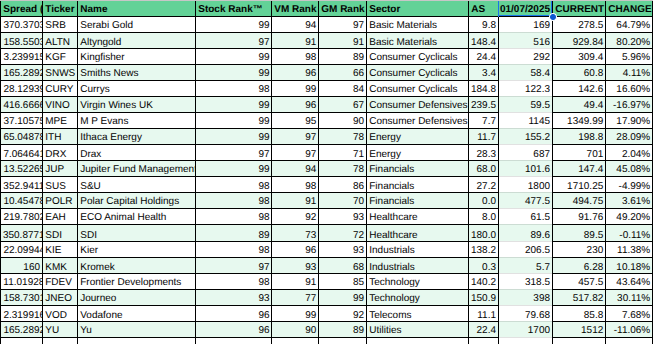

- 22% return before dividends.

- 17 out of 20 winners.

- One takeover. One doubler.

- A new all-time portfolio high.

- No individual stock picking (the NAPS is a passive approach).

- Lots of fun watching them go up.

There’s a long way to go, of course, and anything can happen, but I have had good feelings for 2025.

A year ago, in a webinar (and in the half-year NAPS article) I offered five positive reasons why I felt the UK stock market might be in a good place. I’m rarely one for predictions, but the signals felt right at the time.

There have been wobbles of course, but despite the FTSE All Share rising 8% over the last 12 months, it’s actually now on an even lower valuation (by P/E ratio) than it was then. It still trades at a significant discount to international indices. If the UK stops shooting itself in the foot economically, then perhaps there’s plenty of room left to run.

Quick primer - if you are new or want a refresher

Long-time subscribers will know the NAPS Portfolio well — it’s built on the StockRanks, incredibly simple to run, and has outperformed every UK fund manager over the past decade.

- If you’re new to Stockopedia, start with this 10-year review - it’s a good overview of how the strategy works and how it's fared for 10 years.

- But if you prefer a visual walkthrough, don’t miss this brilliant explainer video by the Financial Wisdom YouTube channel. It’s short, sharp, and nails the essence of the NAPS.

- And if you want a bit more background, I ran this 40-minute webinar recently covering the core principles and logic behind this style of portfolio approach.

What’s worked in 2025

At the start of the year, I said the portfolio would need to rise 40% just to reach the average UK market valuation…