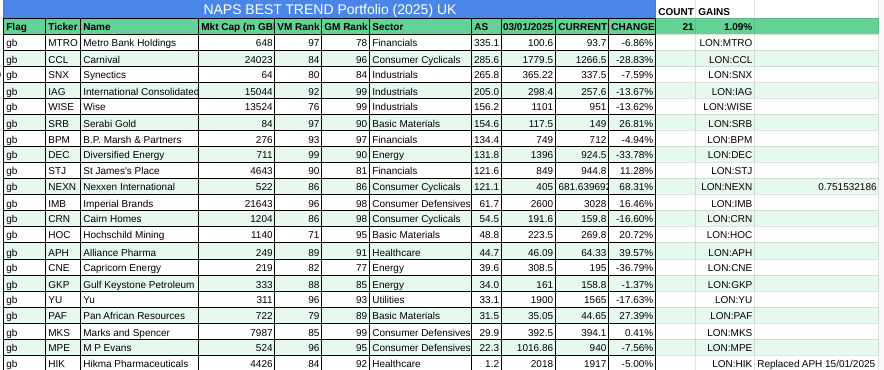

Well the last few weeks have been a bumpy ride to say the least, but oddly enough the The NAPS Portfolio closed yesterday at a new high. This is a portfolio that I’ve been running for ten years on a fully systematic basis, just buying a portfolio of 20 high ranked stocks and rebalancing annually. It’s got a terrific track track record. This year, we thought why not challenge it with a discretionary portfolio, based on similar principles, but incorporating a few more dynamic rules from the research insights we’ve garnered over the years. This portfolio is called the QVM Portfolio and was seeded with the same 20 stocks as the NAPS. After a bid for Alliance Pharma in January, this position was switched into the next highest ranked pharma stock - SDI. So while there is some divergence already, it’s minimal, so we’ll discuss both together.

Q1 Performance

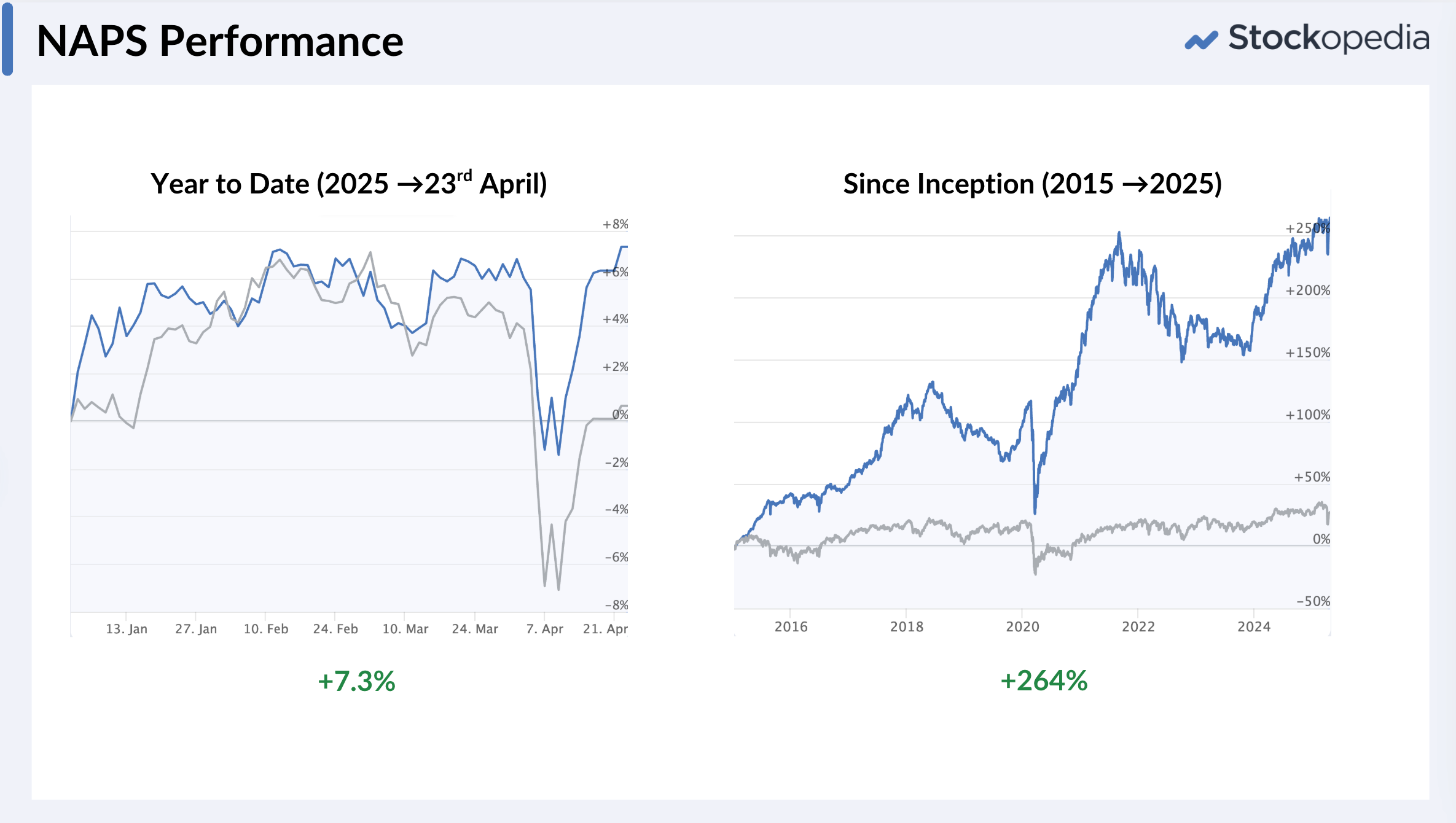

Forgive me for quoting this performance up to the 23rd April rather than the end of quarter, but the numbers are broadly similar. The NAPS are up 7.3% year to date, with the QVM up 6.9%. The switch from Alliance Pharma into SDI has created a small performance drag. Nonetheless, both portfolios are significantly beating the FTSE All Share +0.6%, and at new all time highs. =

This is a good result in what’s been a very turbulent market period. The portfolios fell significantly during the Trump Tarriff Turbulence, but have rebounded quickly. In fact, in spite of all the negativity around markets at the moment, the new all time high makes me optimistic for the coming year.

Winners and Losers - some themes

I can’t stress enough how important diversification across sectors is to the performance of the portfolio. The chart below shows the biggest 7 winners and losers in the 20 stock portfolio. Two key winners themes stick out…

- Two junior gold miners have been the strongest winners year to date - Metals Exploration and Serabi Gold (+61% at the time of writing last night - though has tumbled 15% from there on a placing this morning). Gold is a great diversifier, and it’s a hedge in times of market turbulence with the gold price at a new all time high. There’s not too much research on junior gold miners in the UK, but they’ve…