Nationwide Accident Repair Services (LON:NARS) is an interesting stock to me because it sits in such a bizarre spot. It provides pretty specific services - and, in the manner that I love, tells you what it does in the title. They're the largest accident repair network in the UK, fixing over 200,000 cars a year and with the usual sideline bells and whistles (mobile glass repair etc.). Perhaps it's just me and my simplicity, but I like when companies write things like this fact I found on their website: "In a typical year, Nationwide will repair One in every 150 vehicles on the road". That's a helpful statistic. It helps me get an idea of scale.

Nationwide Accident Repair Services (LON:NARS) is an interesting stock to me because it sits in such a bizarre spot. It provides pretty specific services - and, in the manner that I love, tells you what it does in the title. They're the largest accident repair network in the UK, fixing over 200,000 cars a year and with the usual sideline bells and whistles (mobile glass repair etc.). Perhaps it's just me and my simplicity, but I like when companies write things like this fact I found on their website: "In a typical year, Nationwide will repair One in every 150 vehicles on the road". That's a helpful statistic. It helps me get an idea of scale.

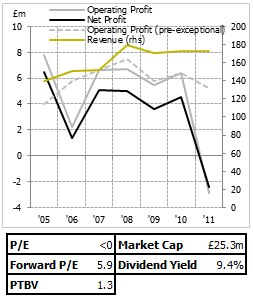

I started looking at NARS late last week after thinking about what companies could possibly eat up the growing cash pile in my portfolio. I don't like holding cash. It's a non-productive asset. It's not the first time I looked at them, though; that 'honour' came almost 10 months ago, when the price was almost exactly the same as it is now. How time flies and my opinion changes! While I considered that it'd "end up looking pretty cheap" in any case back then, now I can't really find a way to like the shares - despite their huge yield and cheap P/E. There's three main risks, and I reckon they're not particularly rare ones, so I think it's a good case study to list them all here.

Customer concentration

This is something I noted back then, actually, so not too big a slap on the wrist for me in this case. 38% of their revenue comes from their 2 largest customers (insurance companies), though this peters out slightly, as only 75% of their revenue comes from their top 20 customers. The first fact is worrying - the second not so much. The loss of either of their big 2 customers would be a hammer blow to the business, particularly in combination with the points I'll come on to in a minute. However, it's certainly not as bad as it could be. One of the distinct advantages of being the biggest is that customer attrition is lower than in smaller, more competitive industries. I doubt their customers have much incentive to move. Secondly, and while this could…

.png)