Introduction

NewRiver Retail is a REIT (real estate investment trust) set up in 2009 to capitalise on investment opportunities made available by the financial crisis (with portfolios sold at knock-down prices by forced sellers). The founders of the trust have long experience and excellent track-records in this arena; in particular CEO David Lockhart's last company Halladale grew its NAV from 63.7p in 2001 to an offer price of 225p when taken-over in 2007. In total a shareholder return of 440%; great timing and an excellent result. The specific aim of NewRiver Retail is to repeat this level of success through opportunistic purchases, at a minimum yield gap, and active management of asset improvements.

The company certainly got off to a flying start by pre-arranging a management agreement with Scottish Widows before completing a number of off-market purchases, in the first year, and entering into a joint venture with Morgan Stanley. Since then the growth trajectory has been relentless although with a subtle shift in focus from mostly buying assets on their own account to engaging in joint enterprises where they provide the management expertise. Looking at the names of their recent heavyweight partners, such as PIMCO, it's clear that NewRiver Retail is seen as a safe pair of hands and it's a fair endorsement of management quality.

In the IPO admission document the directors put forward an intentional focus on retail, rather than the office sector, and this makes sense when considering historical volatility and returns, the size of the market and concomitant liquidity and the types of national tenants available with whom a relationship may be built. But concentrating on the food sub-sector for anchor stores might not be so golden any more given the turmoil amongst all of the operators and their scaling back of expansion plans and overall contraction. Will NewRiver Retail be left with empty premises if a retailer pays the penalty to break their lease?

Valuing a real-estate investment trust

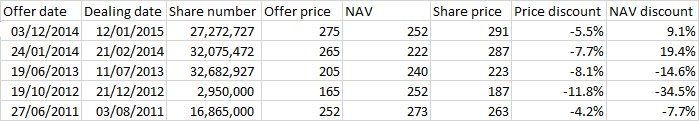

Now trying to value NewRiver Retail is a bit of a step into the unknown for me. Standard valuation metrics are remarkably useless when it comes to assessing property investment companies - items such as free cash-flow, trade receivables and even headline profit margins are distorted by the focus on capital growth and a pipeline of occasional sales. In response to this …