TL;DR:

NEXT Directory is the driving force behind future growth and recently announced special dividends propel this share into high-yield territory.

NEXT Directory is the future

Three months ago I spent some time analysing NEXT from the private investor perspective. From this I concluded that NEXT is a superbly run company producing great results and would be a fantastic buy - in 2008. Back then the shares were, demonstrably, a steal at less than £10; in the 5 years since earnings per share have more than doubled and the share price has multiplied seven-fold!

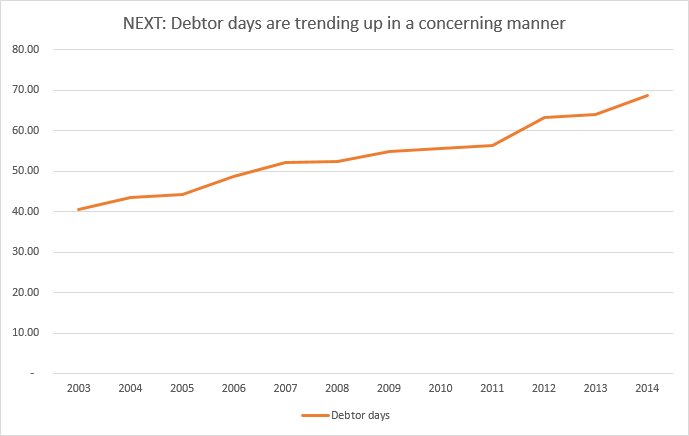

However besides NEXT shares being expensive, by most metrics, the graph that really gave me pause for thought last year was one of debtor day history. Typically a rising trend-line suggests that a company is relaxing payment terms for its customers and/or having difficulty collecting the money that it's owed. With NEXT Directory becoming ever more important I wondered if this was a harbinger of upset ahead:

Recently though I've come back to NEXT following their Christmas trading statement. In this management set out how sales growth, of 2.9%, came in at the upper end of previous guidance and that full-year profits will hit a tight range of around £775M. So the picture looks pretty rosy although with a decent slug of realism concerning economic prospects for 2015 and tough comparables from last year.

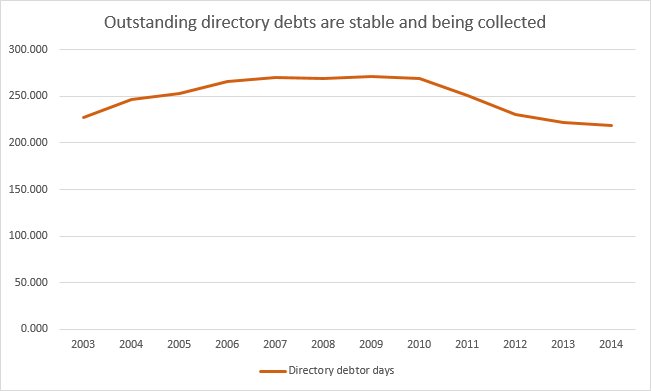

While considering this statement I realised that previously I erred and should have thought to examine the turnover and receivables of Retail and Directory separately. In the former there are almost no receivables as customers willingly hand over their cash before the company even pays its own suppliers! With Directory sales there is, by design, a long credit period for customers and thus a tail of outstanding debtors. It turns out that despite Directory turnover almost tripling in the last decade this tail remains well managed:

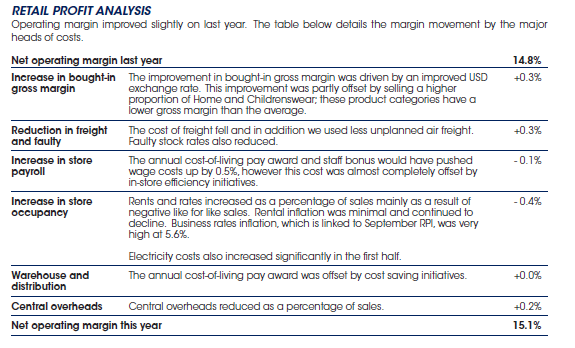

With this Retail/Directory split in mind I've also plugged into my spreadsheet the operating profit figures, for each side of the firm, to check how the margins stack up. Previously I looked at the blended margin, which is both stable and high at around…

.png)