Next remains a class act and every new annual report just confirms this!

Introduction

I first looked at Next almost exactly a year ago and decided that it was just a bit too expensive to justify purchasing. At this point the share price was £64.50. A few months later, in February, I revisited the figures and reconsidered my position in the light of the board's switch from share-buybacks to special dividends. Even at a share price of £71.20 these payouts implied a yield north of 4%; pretty punchy for a HSBC Bank (LON:12BN) company still-growing its mail-order offering. It turns out that these were both decent entry points with the share price now hovering around £79.50 and buybacks remaining off of the menu. The question that I'm interested in now is whether Next is still powering ahead; if it is then, after returning over 25% in the past year (including dividends), is it still worth purchasing?

Analysis

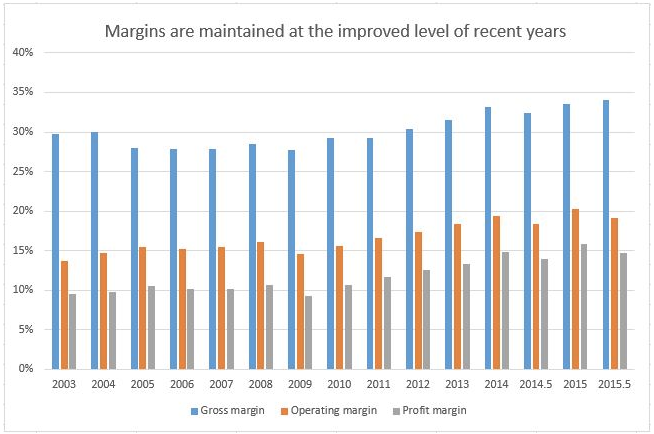

Using the half-year results published last month I've updated my spreadsheet. Margins are the first metric that I like to check as these represent the public face of profitability for a company. The news is good in that all margins have improved against the previous half-year. This implies that both buying (of goods) and staff costs are well under control. Set against the full-year results there is a slight drop evident but seasonality makes sense given how much scope Christmas offers for selling in volume at a top price:

Looking at expenses the cost of sales percentage has been falling for the last decade while the operating cost percentage has remained flat. In layman's terms this means that Next's buying team are keeping charges down, possibly as a result of greater volume, while the board have managed to offset increasing labour and retail costs with efficiency improvements and margin hikes. It's rather pleasing that Next are keeping a lid on outgoings despite headwinds from living-wage legislation and building cost inflation. With the former it's plain that staff numbers are reducing as more experienced staff work longer hours for more money; this is just one of the knock-on effects of a regulated minimum wage. To achieve such consistency over more than a decade is a testament to the strength…