One line summary

This successful and durable retailer comes with a high price tag and while its track record is impressive I think that it's best to hold off until a bargain price is offered.

Introduction

NEXT is surely a familiar and recognisable brand to most people in the UK; whether through its retail stores or via the popular NEXT Directory. This is no surprise given that the retailer has been around, in one form or another, for 150 years come 2014. Happy birthday!

The key to NEXT's success is that it offers an aspirational yet affordable brand with a premium image. A tricky act to pull off but one which the company makes its own. In 1988 the company branched out with the NEXT Directory, in a bid to revolutionise home shopping, and struck gold. Apparently there are currently over 3 million active Directory customers and I imagine that they eagerly await each new edition.

Sensibly NEXT remains largely a UK operation (90% of turnover is generated in this region) and given the shocking international failures of Tesco and Marks & Spencer I think that this is a wise decision. Then again the company did burn a few million pounds back in the 1990s when opening some trial stores in the US. Apparently a lesson well learned!

Full year accounts for 2013

There are many good reasons to like NEXT but from an investment perspective their commitment to clear and uncomplicated financial reporting is a breath of fresh air. Regulatory statements are produced promptly and yet still manage to provide actionable figures and unambiguous guidance on current forecasts. Why aren't more companies this helpful?

The latest annual report is a case in point. In the first few pages the most important figures (turnover, profit and dividends) are highlighted along with a clear indication that returning profits to shareholders is an explicit focus. There isn't a chest-beating biography of any director here; just a summary of objectives to help the company serve its customers and owners effectively.

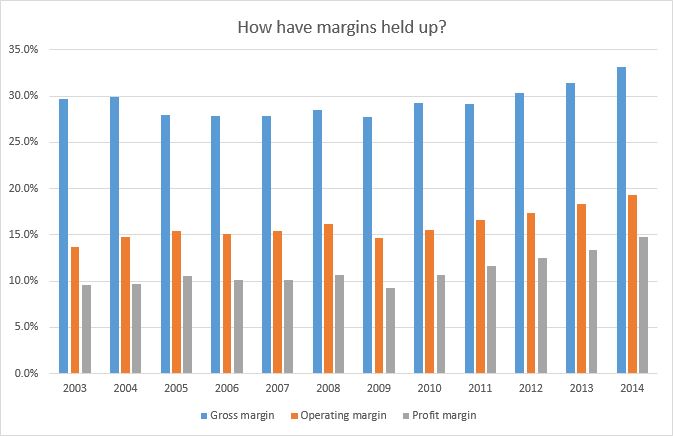

Looking at the figures over the last decade it's obvious that NEXT's growth record is excellent; managing not only to maintain margins but to increase them year-on-year. The business escaped the financial crisis largely unscathed and continues to evolve as a lean, mean profit machine:

However…