Year on year comparatives grim. Price down 7% on results day, 40% since Jan ‘22. A deep-value diamond or 'structurally challenged mid-sized player'?

We know when the very first bullet point on a results announcement is “A year of significant headwinds”, the numbers are going be ugly. Indeed, for asset manager Ninety One (LON:N91), they were. In the FY ending 31 Mar 23:

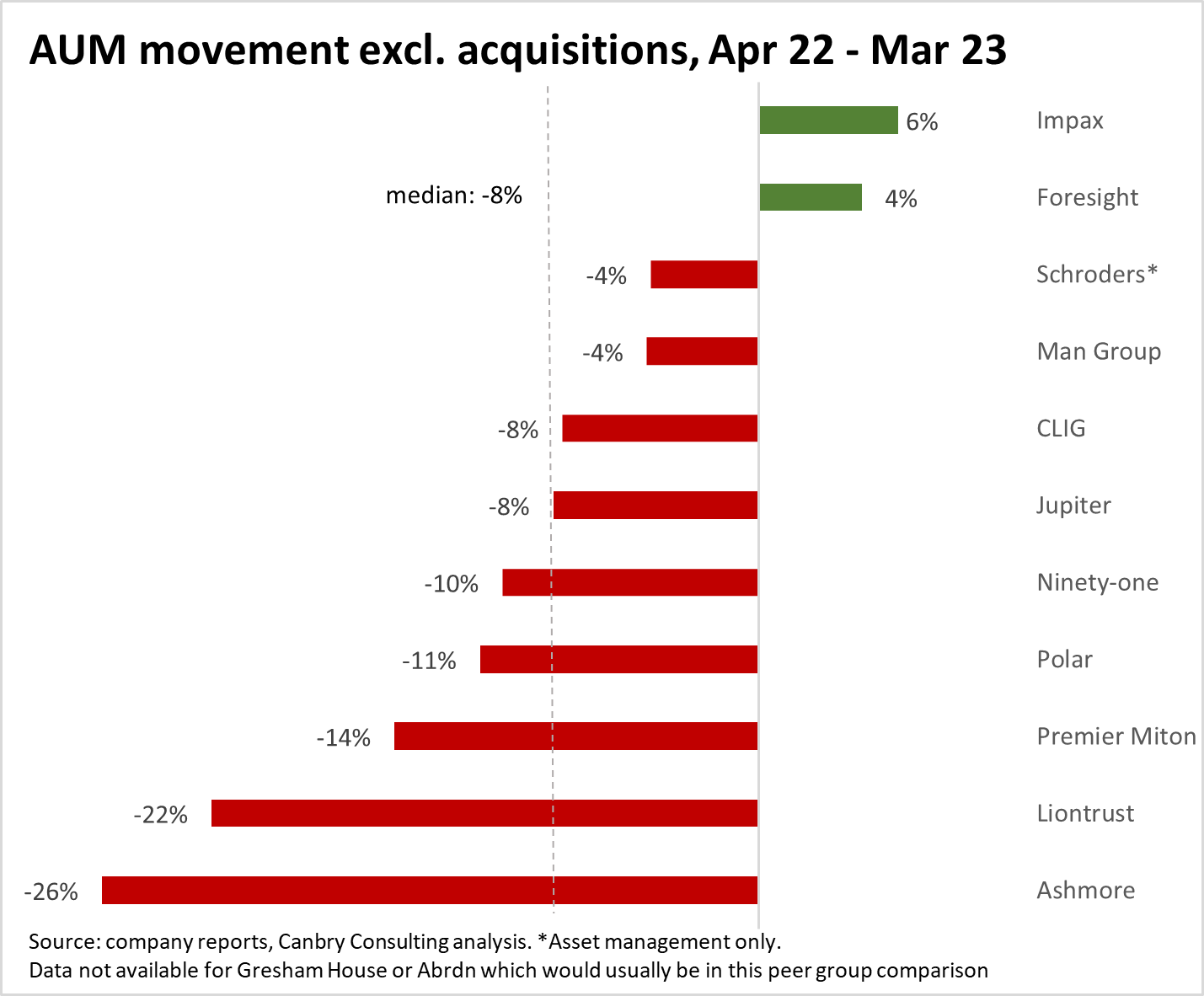

- Assets under management (AUM) fell 10% to £129bn;

- Revenue fell 6% to £627m; and

- EPS fell 19% to 18.2p (on the 17 May 23 closing price of 160.40p, that’s a PER of 8.8).

The CEO’s report stated: “The 2023 financial year has been difficult for our industry and for Ninety One. Coming off a record year in 2022, we faced the combination of higher inflation, the fastest rise in interest rates since we started the business, heightened geopolitical uncertainty, a liability-driven investing (“LDI”) crisis in the UK, significant bank failures in the developed world and energy shortages across the world. All of this led to unprecedented risk-aversion among asset owners. This created significant headwinds for a firm like ours, which primarily offers “risk-on”, public-market strategies. Furthermore, and regrettably, we have to mention the deterioration of economic prospects in our original home market, South Africa, where we have a substantial business… These circumstances have impacted our results, in particular, our net flows.”

All of that is valid, with Ninety One's AUM decline over the period being just below a London-listed asset manager peer group median.

[For a more detailed look at the UK-listed asset management sector over 2022 and in Q1-23, you may want to read my recent asset and wealth management newsletters: Want to know how UK asset managers differ from each other? 2022’s bear market will show you!; and Tug-of-war between investment returns and net flows in Q1-23.]

Investors Chronicle didn’t mince words in its very-to-the-point take on Ninety One's results: “the shares have little immediate attraction. Sell.”

Of course, they might be right. But I think that might be a bit of a hasty take. Yes, it was a grim year for Ninety One. But when, even in such grim year, a business:

- generates £213m of PBT at a margin of 34%;

- has cash on the balance sheet of £380m and no borrowings;

- produces a dividend yield of…