Well I don't mind saying that this has been a shocker of a month. I can't remember such a destructive period for a number of years but such is the risk of being fully invested and not using hard stop-losses. It's not that I'm unaware of the use of stop-losses, and I do use alerts to pick up on sharp falls, but I've come to realise that they don't really work with either my strategy or my psychology. Instead I'm looking for companies which should grow and prosper over the next 5-10 years and I'm willing to endure capital volatility along the way (since I don't intend to draw-down on this capital for 10+ years). If a profit warning comes along then I'll close a position without hesitation but beyond that I'm looking to remain invested in my holdings. Obviously this tactic looks a bit silly right now, especially when a good number of folk are tweeting about how they presciently sold everything and went to cash in the summer but you can't win them all.

Purchases

Burford Capital Bought 1859p and 1612p - October 18

Well the board at Burford employed outstanding timing at the start of the month by raising $250m from institutional investors at 1850p. When the price fell to this level the day after I figured that with the price at £20 just a few days before this was a good chance for me to top-up at more or less the equity raise level. In hindsight this was remarkably poor timing in the short-term; in the long-term I am absolutely sure that Burford will continue to deliver outstanding results and that the forecast P/E of ~17 will prove to be materially wrong. My reasoning here is that Burford has been employing ever increasing amounts of capital and that the profits this year are down to investments made several years ago (which is how it works every year). So their market is growing and Burford have an ever larger portfolio of cases in progress. Hence I made a second top-up recently to benefit in some way from recent volatility.

XP Power Bought 3048p and 2594p - October 18

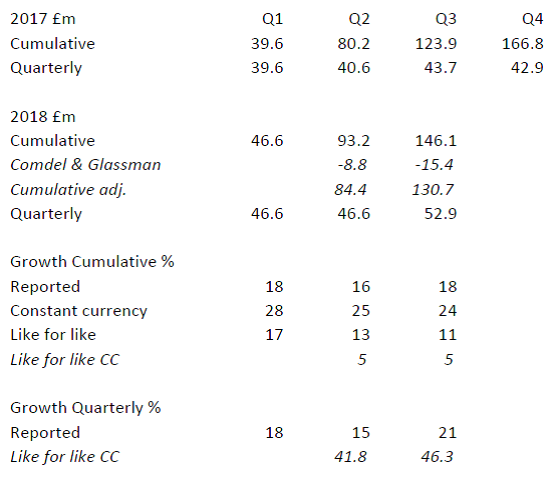

As mentioned in my comments on the Q3 update below I think that XP Power is trading very well and is not at all expensive when you look at the forecast growth. Thus I added to my holding after…