On Oil, it has been fashionable to be long of the black stuff given falling oil production in Venezuela, plus the resumption of US sanctions on Iran, both two important OPEC producers.

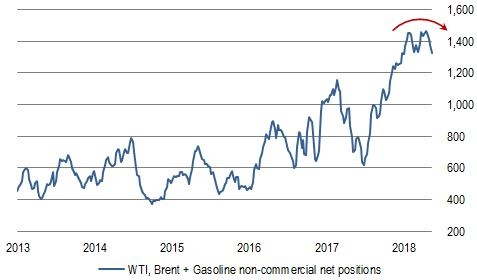

As global crude oil inventories have fallen back to 5-year seasonal averages, thanks in large part to good quota compliance from OPEC+ (including Russia), the glut of crude oil on the world market seems to have been cleared.

1. Global oil inventory glut seems to have been cleared

Source; EIA

As a result, Brent crude oil (CO1 in the chart below) has leapt to a high of $80/barrel, before easing back to around $77 at time of writing, with West Texas Intermediate (CL1) opening up a spread of over $10/barrel - the highest such spread in over 3 years.

2. Brent and WTI crude oil prices have rallied hard

The trigger for the pullback in Brent from $80 a few days ago was the news that Russia and Saudi Arabia were considering loosening their quotas on oil production for H2 of this year, given the resounding success of the OPEC+ quotas thus far. But in the end, they seem to have opted to maintain quotas, as least for now.

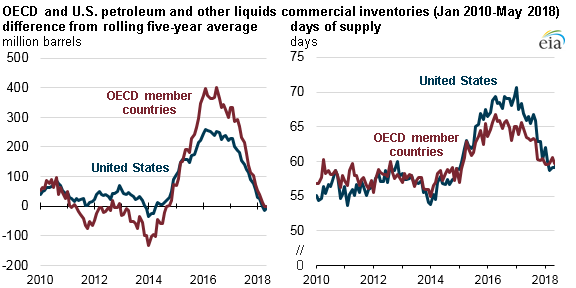

This also triggered some profit-taking in oil positioning by speculators, given the extraordinary long positioning of non-commercial players (i,.e. investors and hedge funds) in oil and gasoline futures and options.

3. Speculators start to sell out of their very long oil positions

Source: CFTC

Since mid-2017, the European Oil & Gas sector (white line in chart below; led by Royal Dutch Shell (LON:RDSA) and BP (LON:BP.) ) has outperformed the broad European stock market (orange line) by over 18%, reflecting this strong upside oil market momentum.

4. SXEP EU Oil & Gas sector leading the way in performance

So what now? Continued correction, or new oil highs?

Global oil demand should continue to grow steadily, thanks to decent economic momentum in the US, EU and China. So the question is more about supply, in my view.

I suspect from much reading around this topic that spare capacity in the OPEC+ producers is somewhat exaggerated,…