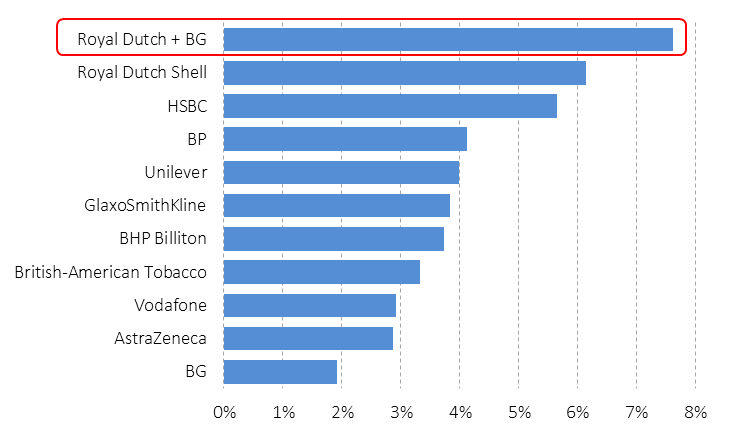

Has a rush to buy up oil & gas companies just started? Royal Dutch Shell (LON:RDSA) is set to become by far the largest FTSE 100 member by market capitalisation at 7.6% of the index (Figure 1), worth nearly £160 billion and 35% larger than the second-largest company HSBC Holdings (LON:HSBA), once it completes the £47 billion purchase of £BG. later this year.

1. Royal Dutch Shell Worth 7.6% of FTSE 100 Post BG Deal

Source: Author, stockopedia.com

In the late 1990s, the oil price plunged to $10 per barrel and set off a wave of oil industry mega-mergers: Exxon with Mobil, Chevron with Texaco, BP with Amoco. Fast forward to April 2015, and once again the oil price has plunged, more than halving from $110 per barrel in July last year to just $50 by January this year.

Now we have a new oil & gas mega-merger, Royal Dutch Shell taking over BG (the gas-dominated exploration and production arm of the former British Gas). This is in fact the second big oil company merger announced in the past few months, following US oil services company Halliburton which announced a merger with rival Baker Hughes in November last year.

Why is Shell Buying BG?

With this purchase of BG, which has been beset by fundamental problems for some time, Shell is buying access to oil and gas reserves in Brazil and Liquefied Natural Gas (LNG) capability. These assets allow Shell to grow their oil & gas reserve base (replacing oil and gas currently being produced) and to be a dominant player in the growing LNG market, alongside the state of Qatar.

The basic idea is this: that the oil & gas-producing assets of BG are cheaper for Shell to buy in principle than developing new oil & gas fields and putting them into production – the so-called “replacement" cost. Why take the risk of developing new oil fields (which may not even produce as expected), when you can buy proven, producing oil & gas reserves off the shelf?

Who Else Could Be Looking To Buy Oil & Gas Assets?

While Shell has already chosen its prey, which other mega-oil companies could also be looking to buy up cheap oil & gas reserves? As the oil…