- Following the rollercoaster ride that has been the last 3 months of last year, and then a strong recovery post-Christmas through to the end of March, we should expect further gains ahead.

- This is a pattern that is evident historically not only in UK equities, but also in the US and European stock markets too.

- Q2's gains are likely to be more modest than in Q1, but still very much worth having.

- Small-caps could catch up to large-caps, following the stronger Q1 bounce in large-caps.

What to expect for stocks in Q2 of this year?

Stock market investors have certainly been treated to some wild gyrations in portfolio performance over the last 6 months or so, falling 13% from mid-September to end-December, and then a 13% recovery so far to early April.

The FTSE All-Share index rollercoaster ride

With all the continuing domestic political turmoil that continues, what can we expect for UK (and overseas) stocks in the months ahead?

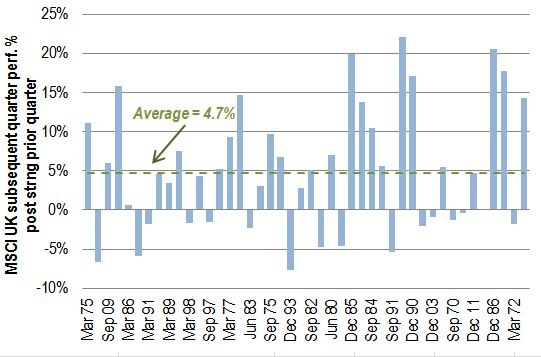

I dug into the historical performance of UK stock markets back to 1970 to get some idea of the quarterly price patterns that we have seen in the past.

Following a strong quarter, stocks tend to rise further in the subsequent quarter.

Looking at the example of the MSCI UK index (which has a longer history than either the FTSE 100 or FTSE All-Share indices), we can see in the chart below that performance following a strong quarter (defined as a return of 9% or more in the quarter) tends to be relatively strong in the subsequent quarter.

UK stocks gain on average 4.7% following a 9%+ strong quarter

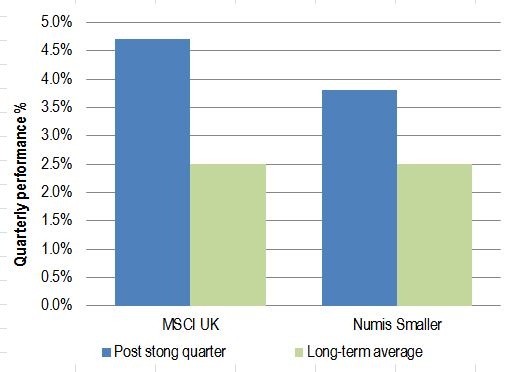

This average gain for UK stocks of 4.7% is better than the average quarter historically since 1970, which comes out at 2.5%. UK smaller companies also do better than the average quarter, but not by as much at only 3.8% on average for the subsequent quarter.

UK stocks do better than average post a strong quarter

Going further, what happens after one negative quarter, then a postiive one?

We can narrow down this analysis to look only at instances where UK stocks have first suffered a heavy loss over one quarter (as happened in Q4 2018), then a sharp rebound in the following quarter (as in Q1 2019). …