Today I wish to report on a miracle in banking:

Pcf (LON:PCF)

This company is achieving miraculous firsts and new innovative approaches in banking...frankly its sexy and not dull...I would unabashedly make love to it if I could...

Here are the key amazing things I learned on today's Equity Development call with the CEO:

- Increasing lending through a pandemic and flash depression is conservative risk management

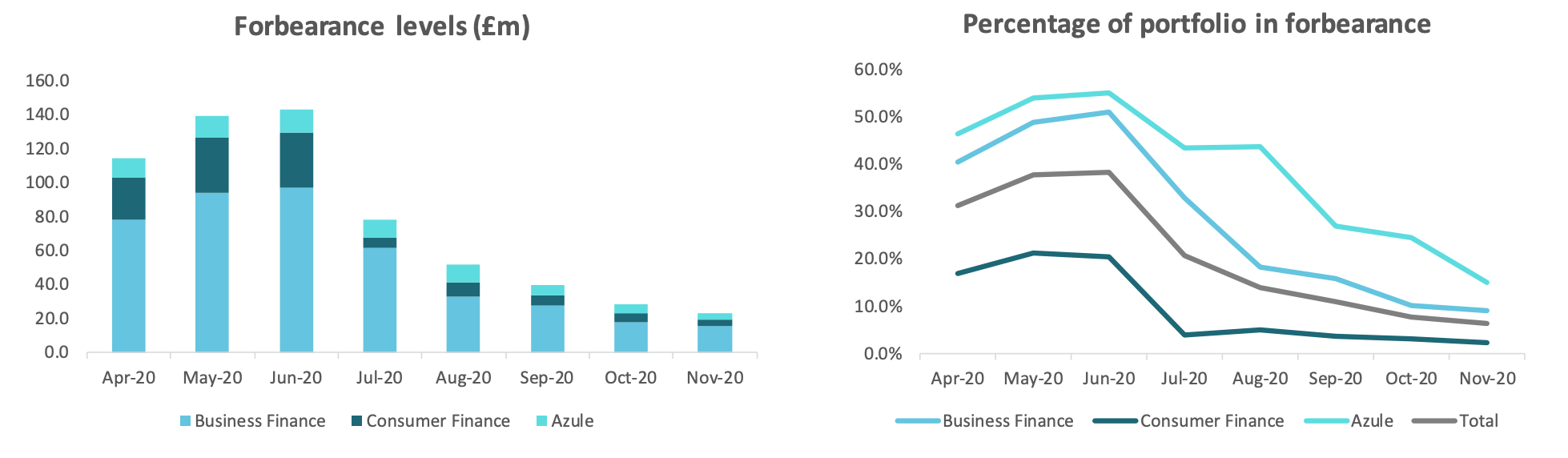

- Lending more to existing customer base (+28% portfolio growth when new business originations fall) whilst forbearance goes up massively (ie customers experiencing stress) is conservative risk management

- When a new acquisition like Azule to which you had aggressively ramped up lending (in area, production services, that is notorious for viscous cycles and precarious economics for many participants but you said it was low risk as you'd got security on the cameras etc) takes a massive impairment this is clearly NOT as you don't employ conservative risk management

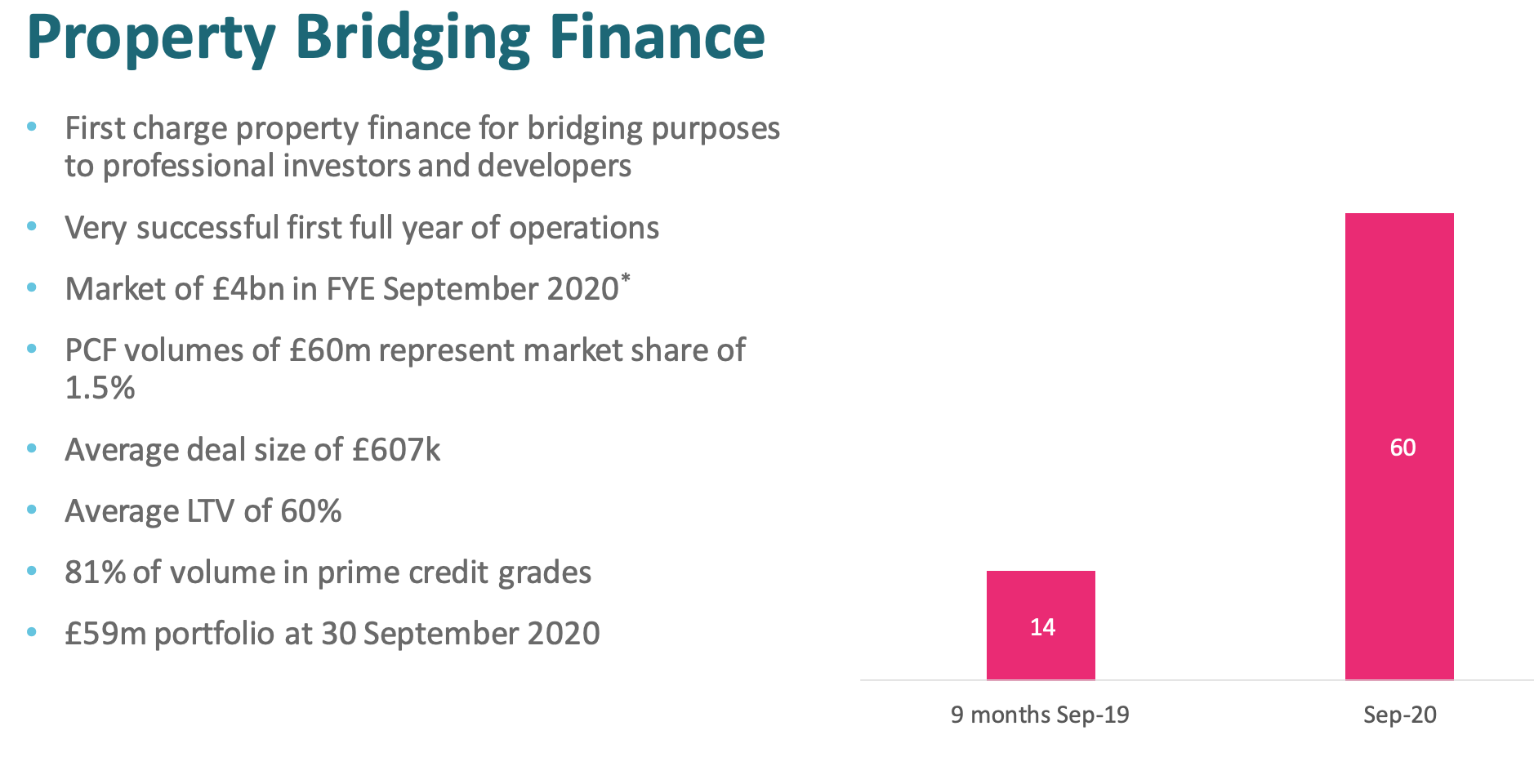

- More than doubling a new area of business, property bridge financing, during a crisis is conservative risk management

- ...LTV 60% average....brilliant....average UK bank has their mortgage book really well covered too as security price (the house) has risen and much more than loan....so this situation is not really different from say Lloyds...but we love PCF for it as obvs they are better at selecting the risk (even though they are in a new area)....no need to worry about the market freezing during a flash depression and so assets been stranded here (leading to duration mismatch stress, liquidity problems and then solvency)

- Taking on a super high level of new deposits in midst of a pandemic / flash depression is an act of conservative risk management....IS NOT RECKLESS GROWTH IN FUNDS TO ENSURE THAT FUNDS ARE AVAILABLE TO REDIRECT TO NEW AREAS OF LENDING AS CURRENT AREAS ARE DISABLED BY COVID HIT!!!

YUP! Everything about PCF screams conservative and not cowboy.

TBH, this may work out well for current shareholders as they have recklessly stepped on the gas....and if economic risks keep moderating then they may look like great growth.

IMO they don't care. Their 70% shareholders wants them to grow as fast as possible using capital from public market. If the lending goes wrong they'll step in provide capital and take control of the whole thing at bargain price....but have a much…