I have written before about my strong dislike of Pearson (LON: PSON) the international textbook company and former owner of my old employer, the Financial Times. My dislike isn’t unfounded. Under the leadership of John Fallon (2013 to 2020), the company sold off its most profitable assets, leaving it with an education business which was unprepared for a digital world. That poor management resulted in a series of increasingly depressing financial results and moribund returns for investors.

I must admit that my inherent bias has, on occasion, been a source of pride. Between 2015 (when I started at the FT and joined the army of anti-Pearson journalists) and 2020 (when I left), the company’s share price fell 68%.

But this year, that bias has proved rather unfortunate. In 2022, Pearson has been the top performing stock in the FTSE 100, its share price is up 56%.

I am not alone in ruing a missed opportunity. Most people I know who have ever worked for a Pearson company (or former Pearson company) dislike the stock. As do many of the members of the teachers union, who like to disrupt Pearson AGMs with questions about price inflation and poor quality text books. And spare a thought for famed fund manager Nick Train who called time on is 18-year holding in April this year.

So why have so many of us got it wrong this year? The answer provides an interesting lesson in behavioural finance.

Lesson One: Confirmation Bias

Confirmation bias is a human tendency to seek out information which supports your belief and ignore information which contradicts it.

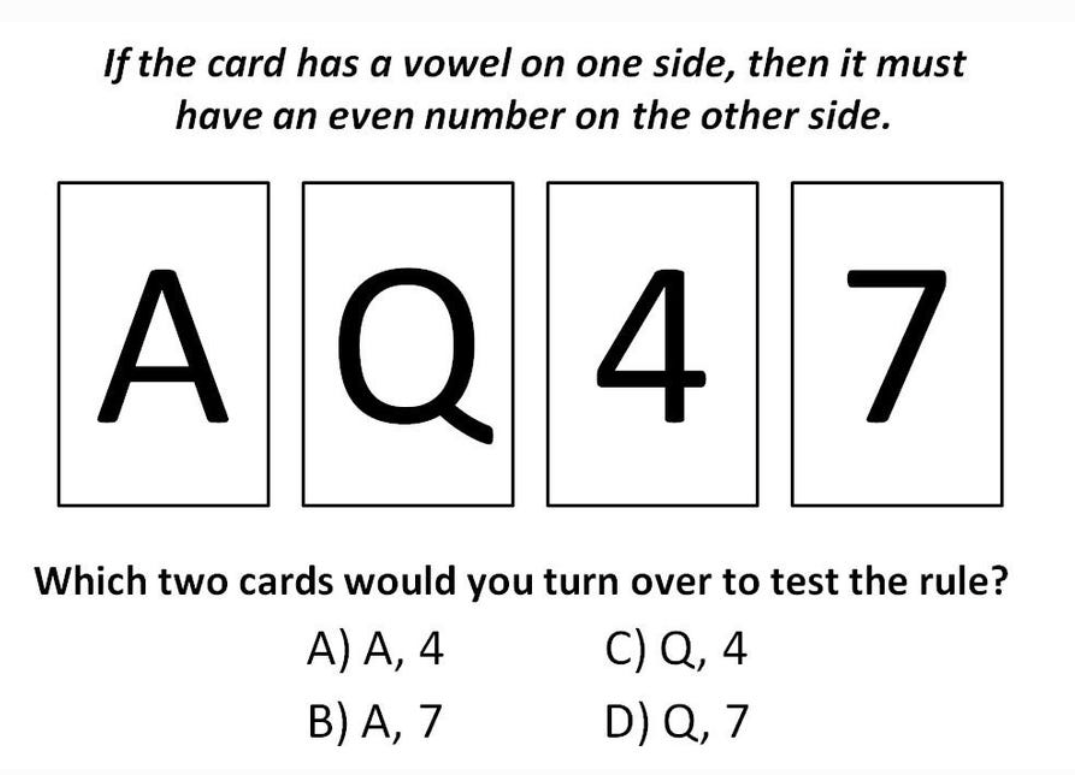

This can be explained by the following example of a Wasson Selection Test:

The correct answer to the question B) To test the rule you should turn over cards A and 7. Turning over A will help you confirm the rule, turning over 7 will allow you to disconfirm it if necessary (i.e. If a vowel is appears on the other side of the card, we will know that the rule is incorrect).

Did you select A and 4? If you did, you’re not alone. Psychologists have used iterations of this test since it was first constructed in 1966 and more than three quarters of respondents get it wrong. Human inherent bias is to seek out information that confirms what they already know (or think they know)…