Has anyone seen a breakdown of Pets at Home's 16% EBITDA margin between merchandise and services segments? My general impression in reading through the reports today was that the merchandise is a slow growing and relatively unprofitable business. The services business grows rapidly and has good margins. The right way to view the merchandise business is as a loss leader to help acquire customers for services.

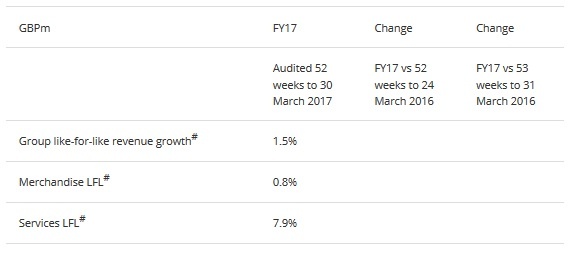

I found statistics that the like to like growth for merchandise is under 3%, whereas the like to like growth for services is over 10%. What is the relative contribution to EBITDA for each of these segments?

I also have yet to see a merchandise / service profit split for Pets at Home (LON:PETS)

This is possibly because the majority of the vet practices are 'in-store' & hence share the same cost base as the merchandise - management would have to make an arbitrary cost allocation to get a profit split.

As you say the services are relatively faster growing:

However, Merchandise has much higher gross margins than Services (57% vs. 32.9%).

The one factor that prevents the group from showing fantastic profitability is the £980million of goodwill that sits on it's Balance Sheet. The ROCE of 8.7% would rise to 61.6% if this goodwill is overlooked.

So Pets at Home (LON:PETS) can be viewed as:

- a fantastically profitable business (in terms of tangible assets)

- a business that has grossly ovepaid for it's acquisitions (in terms of total assets)