Having been out of the market since October 2017, as mentioned here at the time, it is obvious that I am a cautious investor, which perhaps comes from my many years building a financial services company. I am not ready to buy back in yet, but I have been preparing the way and looking at companies that I believe may make good investments. Plus 500 stands out like a beacon of light. As I completed my analysis, I wanted to buy there and then but it was Saturday--an almost perfect company, the thought flickered through my mind “if it is too good to be true” but I dismissed it immediately. When I awoke this morning, Plus was on my mind and I was directed to the Stockopedia blog. I tend to take notice of such happenings as they have both saved and made me money in the past—and there it was an observation from Ed Croft dated 30th May 2018 directing me here https://ftalphaville.ft.com/2018/05/29/1527566400000/Plus500--past-performance-is-no-guide-to-the-future/ with an associated further article. I returned to my desk and wrote across the analysis sheet “they would say that wouldn’t they”!! and binned it.

A 37% drop appears to be very harsh. Marketing spend is totally discretionary so if PLUS wanted to, they could reduce marketing to maintain 2019 profits. The fact that they intend to maintain the marketing spend means that the company has faith in the 2020 numbers. It will be interesting to see what analysts are pencilling in for 2020.

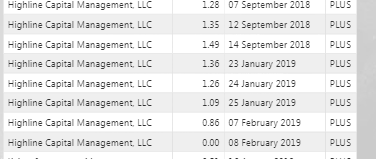

At some time, all the shorters will have to re-buy. I wonder when that will be.