INTRODUCTION

I am no Excel expert but for now this does the trick for me at what are, what seems to be, quite “nervous levels”.

I say nervous on the basis, many markets (including my own portfolio) continue to make new highs when even what appears to be bad news (outlooks) doesn’t seem to be phasing markets. Trump speculation (including impeachment, getting bills past, etc.), Brexit, talk of recovering the QE money, India inflation, Chinese growth, blah blah…

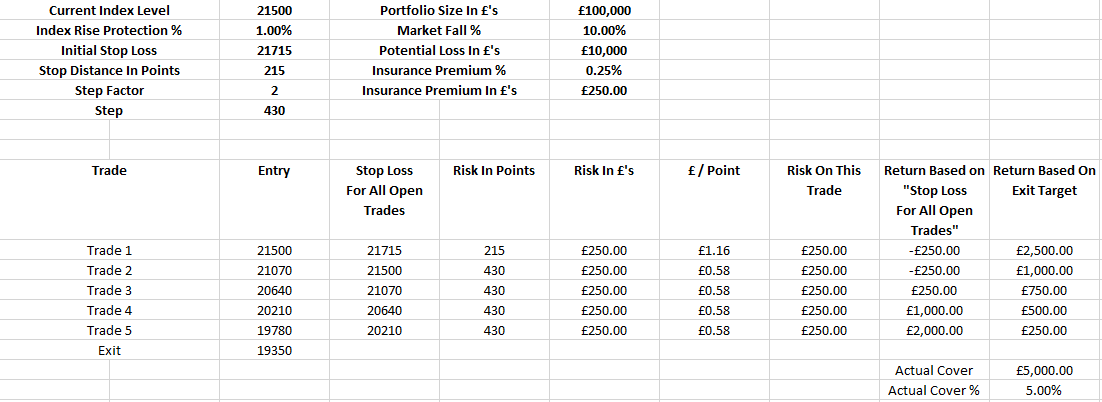

Anyway, attached is the position I have taken to protect each £100,000 of my own portfolio. Basically for a £250 premium (in my Spread bet account) per £100,000 in my portfolio - I cover myself for £5,000 which is 50% of the £10,000 I would lose based on a 10% correction.

OBSERVATIONS

Index

I have picked the DOW as it is quite “toppy” and, what’s the saying? Something like “When the DOW sneezes the world catches a cold”. Now, my portfolio is not directly correlated to the DOW but for me, as my portfolio is quite diversified – This works for me. FTSE would probably work better but it’s not quite as “toppy” right now.

Initial Risk

If the index (DOW) rises 1.00% the assumption is that my portfolio will also rise a minimum of 0.25% to cover the Actual Premium In £’s of £250 per £100,000.

Worst case is my portfolio stands still or makes a small loss – Anyway at 0.25% of the overall portfolio it’s a small premium to pay for a potential 10% loss (£10,000 per £100,000 of my portfolio).

This risk approach kind of, assuming you have a diversified portfolio, means as long as you pick a major index, the approach should work.

So, if the DOW rises from 1% from 21500 to 21715 I refinance my Spread bet account from the, hopefully, gains in my portfolio and initiate a new position starting at 21715 as my initial entry.

Volatility

Each new trade is opened after the index moves down 2% with a 2% stop. The stop for all trades is set to the stop level for the most recently opened trade.

Return Based on "Stop Loss For All Open Trades" reflects the return if the current Stop for all trades gets taken out.

I see no…