Tales of woe in the global stock markets have made me increasingly nervous about checking my portfolio performance as 2022 chugs on. It’s never nice to open your platform and see a sea of red, and it’s especially painful to witness the collapse when there is no obvious remedy. Sentiment is changing and it is hard to know how a new prevailing market force will fare in the the 2020s - retail investors played a far smaller role in the stock market narrative last time value was in its prime.

I take comfort in the fact that I am far from alone in my despondence. Message boards reflect the gloom which has settled on markets, both in the UK and overseas; fund managers are failing to live up to their hype of recent years; and even the stock pickers who have deftly navigated the changing sentiment of the last few months and benefited from the relative outperformance of commodities and energy companies are only sitting on lukewarm returns.

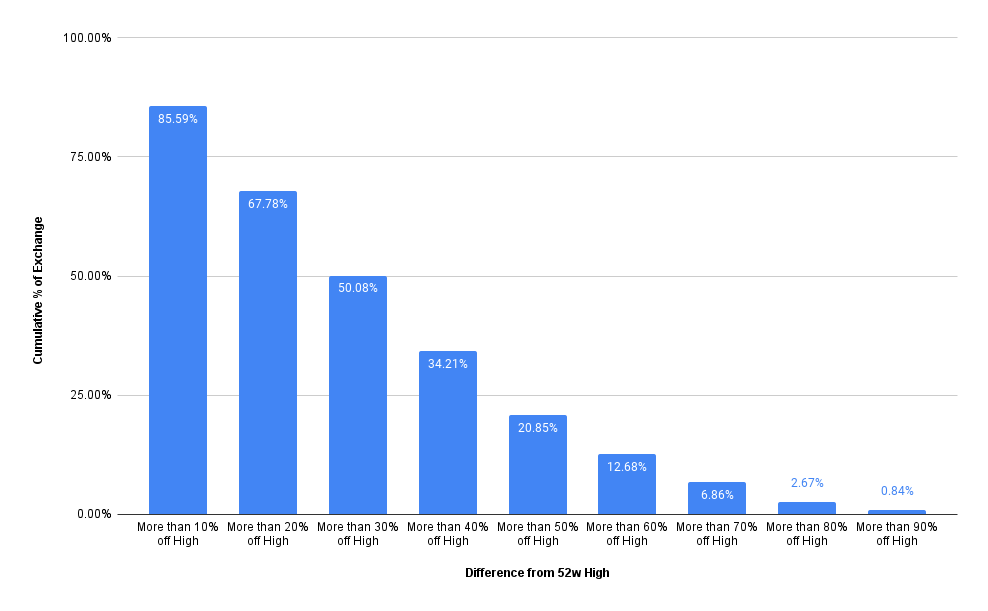

There is also comfort to be found in the knowledge that I couldn’t have done much better - knowledge that was reinforced by Stockopedia’s analysts at the end of last week in an interesting (if not mildly depressing) chart:

As of 11 May, 50% of all of the companies listed on the London Stock Exchange were more than 30% off their 52-week-high, while only 14% were within 10% of those highs. Momentum is certainly not prevailing right now.

The trends are mirrored in the performance of the three key factors which contribute to the Stockopedia StockRanks. In the UK, the companies with the highest ValueRank - a collection currently dominated by basic materials, industrials and energy stocks - have been the strongest group of performers. It’s true, even this chunk of the market has not broken into positive territory yet in the year to date, but its performance is some way ahead of the stocks with the highest Quality/Momentum or Growth StockRank. The two forces which stoked the world’s recent bull run have had a terrible 2022, and the companies with the highest QM and Growth StockRanks have registered a decline of 22% and 35% respectively in the year to date.

But if we can look past the immediate portfolio pain, investors in the UK with a long-term investment horizon could find comfort in recent trends.…