The hotel industry is cyclical with room rates and occupancy levels falling back in a downturn. New hotel supply exacerbates this trend with hotel completions picking up just as a recession takes hold. We are now in the upturn of the cycle and as such PPHE Hotel Group is reaping the rewards.

Companies with cyclical demand and financial leverage have vulnerable business models. This has proven to be the case for a number of banks, real estate developers and ship owners in the post 2008 downturn.

The hotel sector is cyclical with room demand driven by underlying economic conditions. The key metric followed by the industry is revenue per available room (RevPar) which is driven by occupancy and room rates.

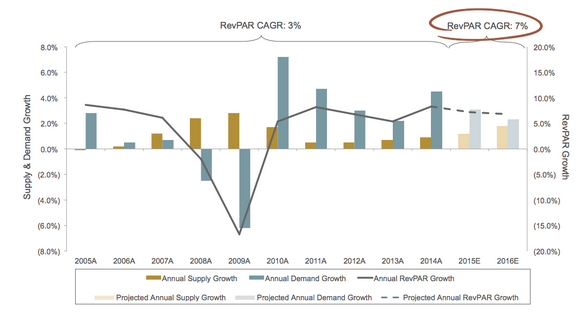

Taking the US hotel industry as case study and RevPar fell back in 2008 and 2009. This was exacerbated by strong annual new hotel supply being delivered in both of those years due to strong hotel construction started before the downturn.

US Hotel industry case study: Demand / Supply and RevPar

Source: Hilton Worldwide investor presentation

PPHE Hotel Group has seen similar trends with hotel occupancy falling from 82.4% in 2007 to 79.1% in 2009. Room rates fell from €118.8m in 2007 to €97.8 in 2009 and as such RevPar was down from €97 in 2007 to €77.4 in 2009.

The effect on revenue was that it fell back from €97m in 2007 to €80.3m in 2009 while EBITDA profits fell from €28.4m in 2007 to €16.2m in 2009. Net debt, meanwhile, rose from €86.5m at the end of 2007 to €403.9m at the end of 2009.

Against this backdrop it is understandable that the shares fell back from over 500p in 2007 to less than 50p in 2008. Operating conditions, revenue and profits have been on an improving trend since 2009 and the shares have rebounded.

PPHE Hotel Group’s share price slump and rebound

PPHE in focus

PPHE Hotel group is majority controlled by its founders Mr Eli Papouchado (77) and Mr Boris Ivesha (69) which makes the shares illiquid. Mr Papoucahdo is the non-Executive Chairman and Mr Ivesha is the President & CEO.

Both executives have a long history in the hotel industry and have been with PPHE Hotel Group for decades. New blood is now coming through in the form of Deputy CEO and CFO Chen Moravsky (44).

In 2014…