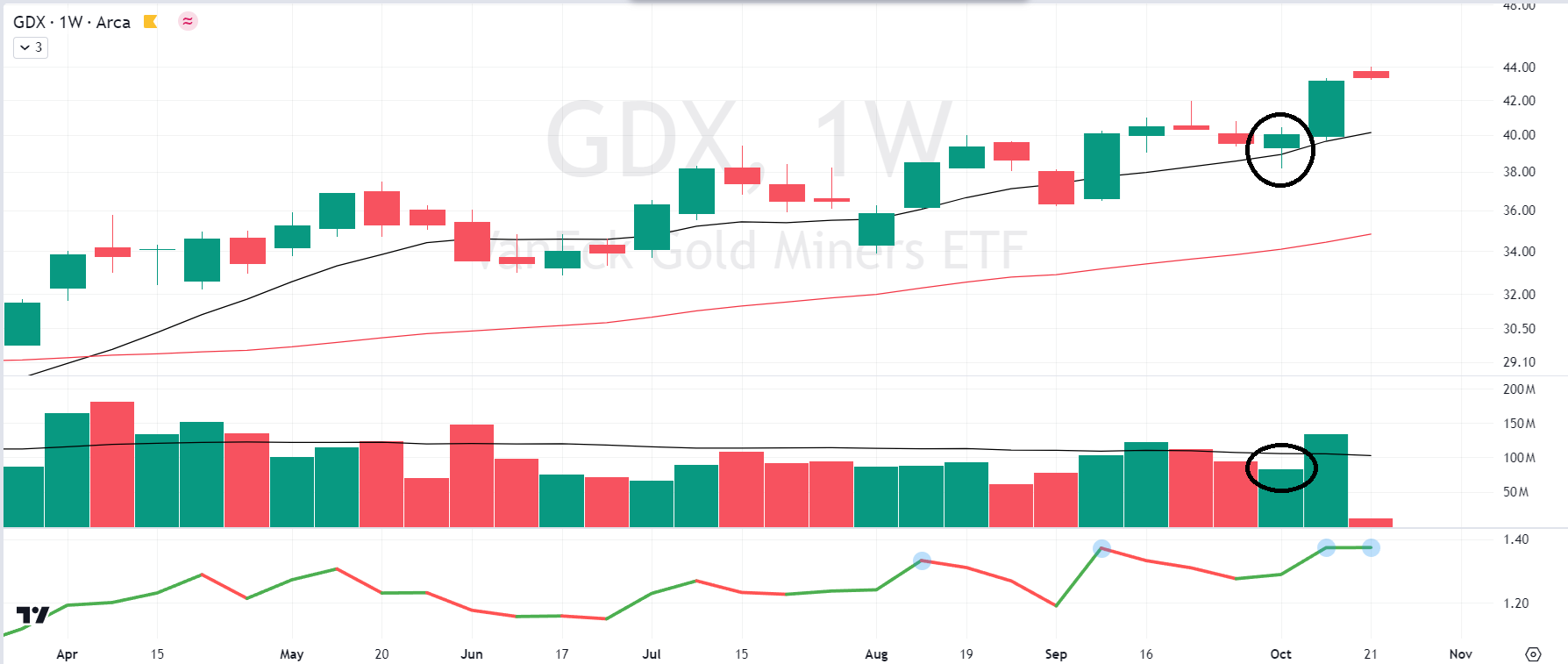

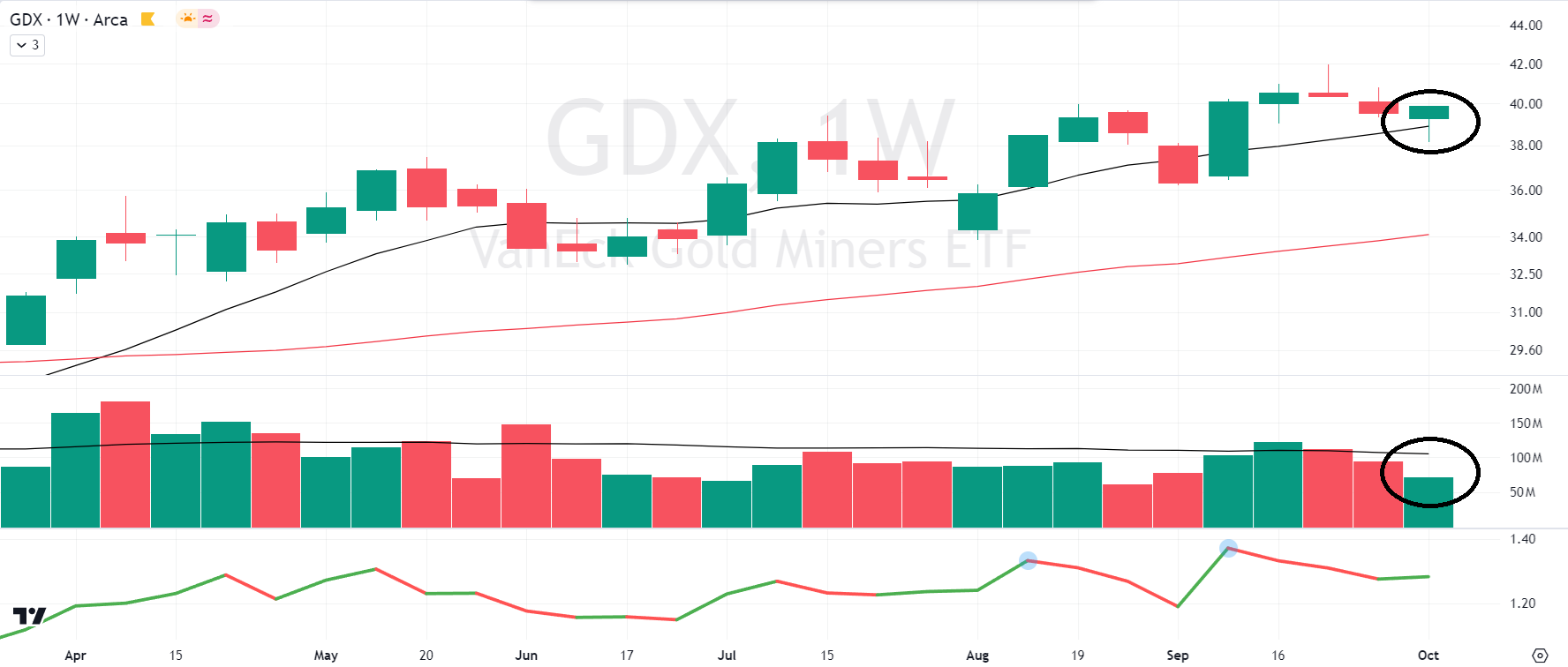

VanEck Gold Miners ETF (PCQ:GDX) one of the main gold miner ETFs on the weekly chart finding support around its 10-week Simple Period Moving Average (SMA) which is closely aligned with the 50-day SMA. Volume is also running below the 30-week average line on the pullback which is a constructive sign indicating a lack of heavy selling.

Around 10-week SMAs is a time to watch for potential institutional support.

Global X Silver Miners ETF (PCQ:SIL) the main silver miner ETF I monitor has the potential for a multi-month consolidation. Price action has tightened on the weekly chart in recent weeks above its 10-week SMA and volume drying up vs the 30-week average.

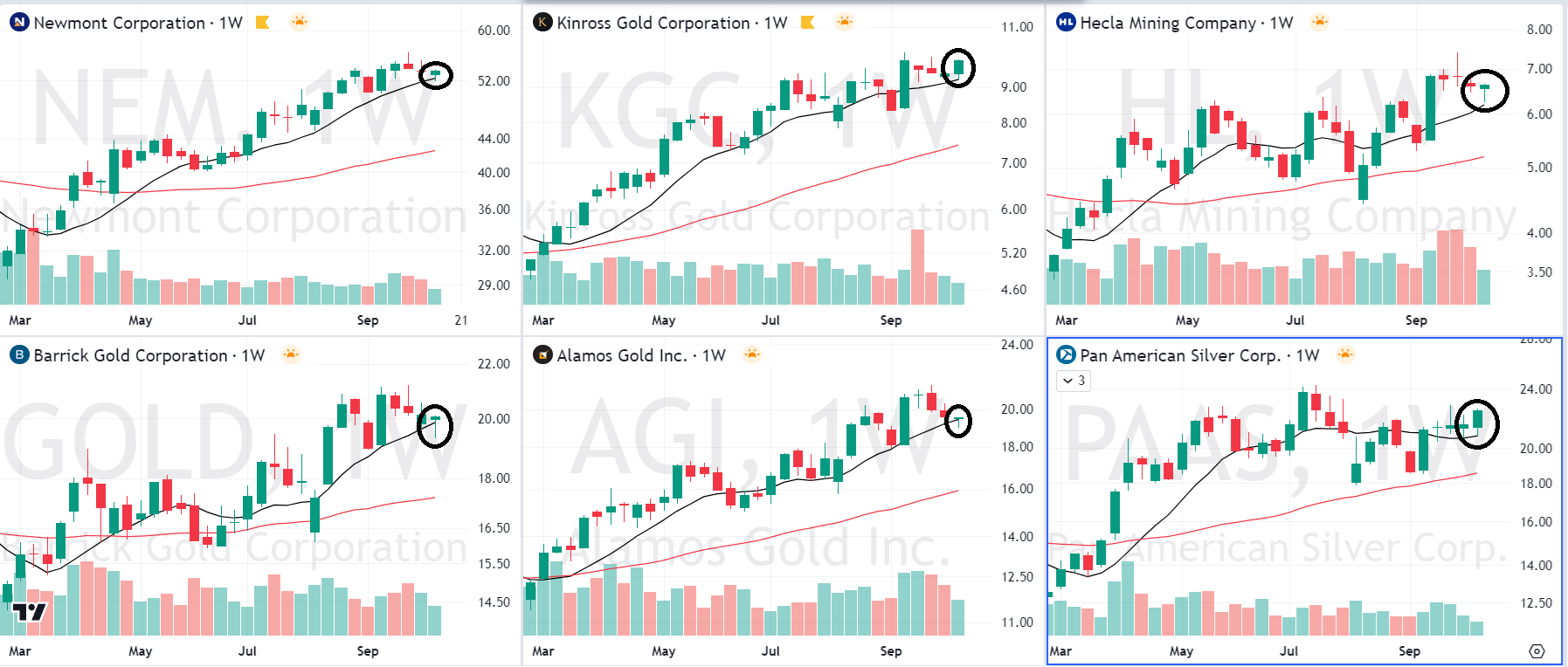

Below highlights several of what I think are the current precious metal mining leaders from a fundamental and technical perspective.

Large caps: Newmont (NYQ:NEM) & Barrick Gold (NYQ:GOLD)

Junior gold miners: Kinross Gold (NYQ:KGC) Alamos Gold (NYQ:AGI)

Silver miners: Hecla Mining Co (NYQ:HL) & Pan American Silver (NYQ:PAAS)

Note on the weekly charts below the supportive action around the 10-week SMA.

Below is analysis from ChatGPT on gold, silver, and precious metal miners:

Detailed Analysis of Gold and Silver: Fundamentals and Miners' Share Price Appreciation

Gold and silver, as precious metals, have historically been seen as safe-haven assets, stores of value, and hedges against economic uncertainty. Their performance is influenced by a combination of macroeconomic factors, including inflation, interest rates, currency dynamics, and geopolitical risks. In this analysis, we’ll explore the fundamental reasons why gold and silver may continue to perform well and how this could translate into share price appreciation for precious metal miners.

1. Macro-Economic Factors Supporting Gold and Silver Prices

a) Inflation and Currency Debasement

One of the primary drivers of gold and silver prices is inflation. Both metals have historically served as hedges against inflation because their intrinsic value tends to rise when fiat currencies lose purchasing power. In a period of inflation, investors often flock to gold and silver to protect their wealth from the declining value of paper currencies.

- Persistent Inflationary Pressures: Post-pandemic stimulus measures, supply chain disruptions, and increasing wage…