Some of the best companies in the world can be found in the Consumer Defensives sector. They make things people need like food, drink, and soap. It’s a solid place to look for long term opportunities.

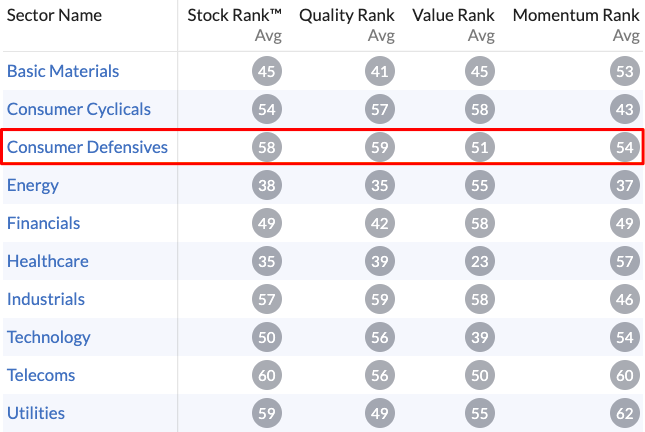

In fact, head over to the Browse section and you’ll see that the Consumer Defensives sector has one of the highest average StockRanks of all the sectors:

Two interesting candidates aren’t so much high flyers giants as unloved contrarian turnarounds, though. Premier Foods (LON:PFD) and Pz Cussons (LON:PZC) : two companies with long operating histories and strong brands that have fallen from grace. The question is can they bounce back?

Judging from its share price chart, the Premier Foods recovery is already under way. PZ Cussons, on the other hand, continues to languish at its lowest share price in a decade but the community has been buying:

Clearly some people are betting on PZC reviving its fortunes. With operations dating back more than a century and supported by strong consumer goods brands, I can see why.

Let’s take a closer look - first at Premier Foods with its gravity-defying share price, and then at PZC to see if there is any readacross.

Premier Foods (LON:PFD)

- Share price: 77p

- Market cap: £662.45m

- 1y relative strength: +148%

- StockRank: 97

(I hold)

For a long time, Premier Foods was just too risky for many investors. Companies change though. Sometimes perceptions take a while to adjust to those operational and financial improvements - I think that might be happening here.

After years of being dead in the water at between 30p and 40p, the shares are finally turning. Look at the chart and you can see something’s happening - the shares have nearly trebled in about three months on historically high volumes of buying activity:

Premier Foods is materially de-risking itself and there is a clearly identifiable share price catalyst. This clear and transformational catalyst is a ‘landmark’ pensions agreement that should make its shares far more investable for many participants...

Unlocking value at PFD step 1: debt reduction

There are two big weights holding PFD down: the group’s debts and its pension funds. Prospects are improving though. The company has strung together 11 consecutive quarters of UK sales growth and net debt to EBITDA is now 2.7x.

…

.jpg)