Hi, enjoying Stockopedia so far. As a novice to investing, I am curious to understand the stock ranking of Prophotonix. As stated , it is likely to experience severe financial distress within 2 years. Possibly bankruptcy. Yet still the 100 score? Sincere apologies to more advanced investors, if I have missed something obvious, or misunderstood.

Hi Gary,

I think I would rephrase that slightly "it is likely to experience could be at risk of experiencing severe financial distress within 2 years."

The Z score flags up potential risk factors rather than giving a full on diagnosis.

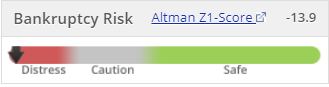

The value for Prophotonix (LON:PPIX) certainly looks worrisome at first sight

Doesn't look like it could be much worse!

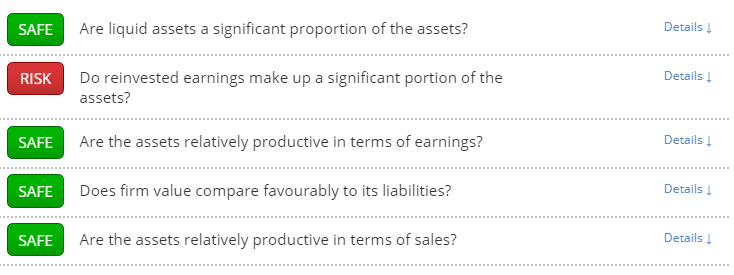

But it is odd when you look at the components.

Four greens and only one red? That red must be really bad!

Well it is (kinda)

Reinvested earnings / total assets are -12.7 x as opposed to a safe threshold of - 0.1355.

I other words they have masses of historic losses, which can be a warning sign of a company rolling out loss after loss after loss before finally going pop.

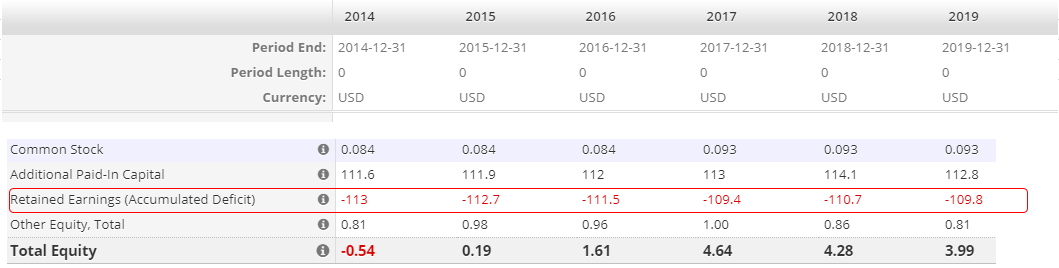

But if you look at the historic balance sheet.

Those losses were incurred over six years ago since when they have been marginally profitable most years.

So it does not look like a true risk factor to me in this case.

I know virtually nothing about the company otherwise (except that 600 (LON:SIXH) used to own a significant share of them at one time planning for some strategic that didn't happen)

If there is a poor Z score it pays to look into it, but it is not (for me) an automatic rejection.