The UK tech sector is booming. Tech Nation’s 2020 report shows that investment in this part of the market surged by 44% in 2019 to some £10.1bn - more than the amount spent in France and Germany combined.

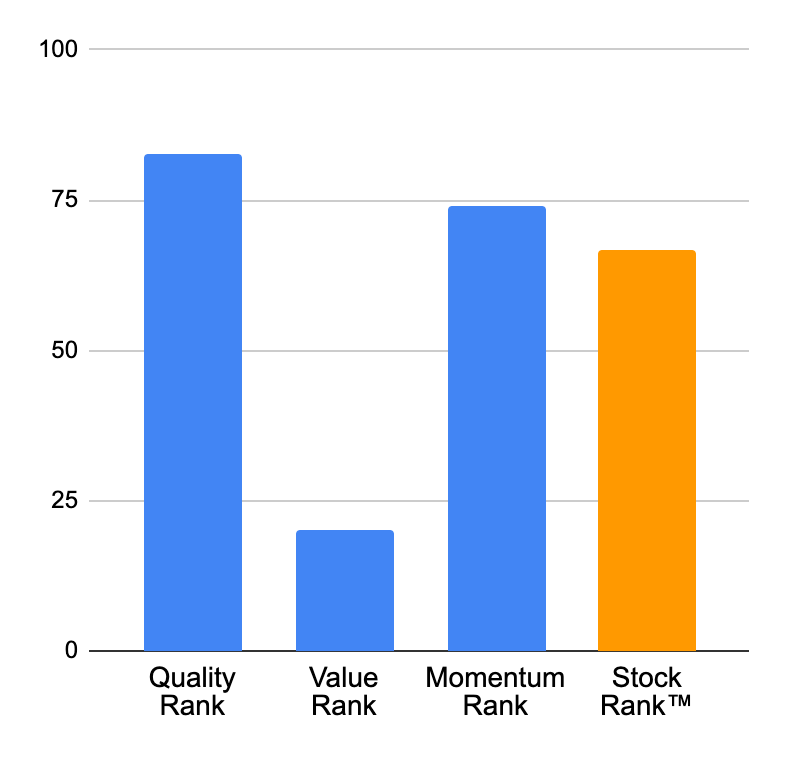

So it makes sense to look for investments in the UK-listed Software and IT Services industry group. Here we have 128 listed Software and IT Services companies to analyse. I’ve highlighted three below: Moneysupermarket.com (LON:MONY) , Fdm (holdings) (LON:FDM) , and Dotdigital (LON:DOTD) . I’m sure there is plenty of opportunity in this space though, so other suggestions are appreciated.

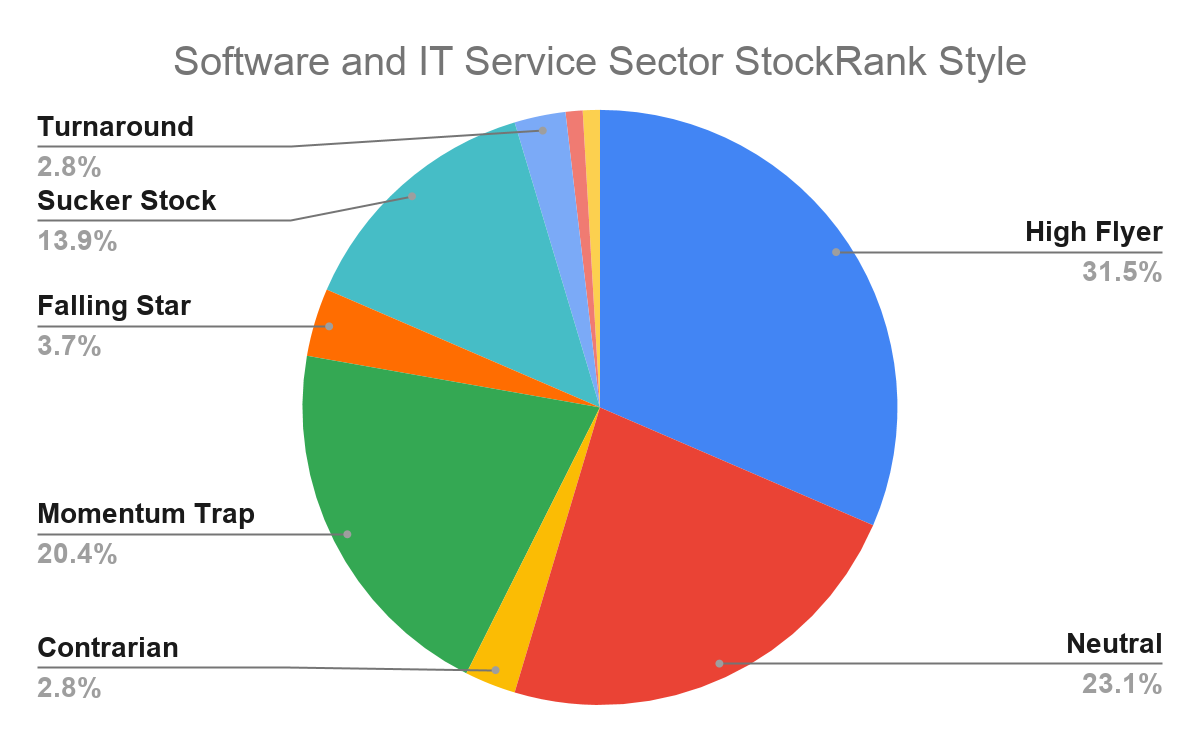

Looking at the group in aggregate there is a clear High Flyer profile:

A lack of traditional value is to be expected in this part of the market. But when you dig down into the Styles, a much more characterful and eclectic picture emerges: for every High Flyer you’re more likely to find a Momentum Trap, Falling Star, or Sucker Stock.

The group begins to come to life now.

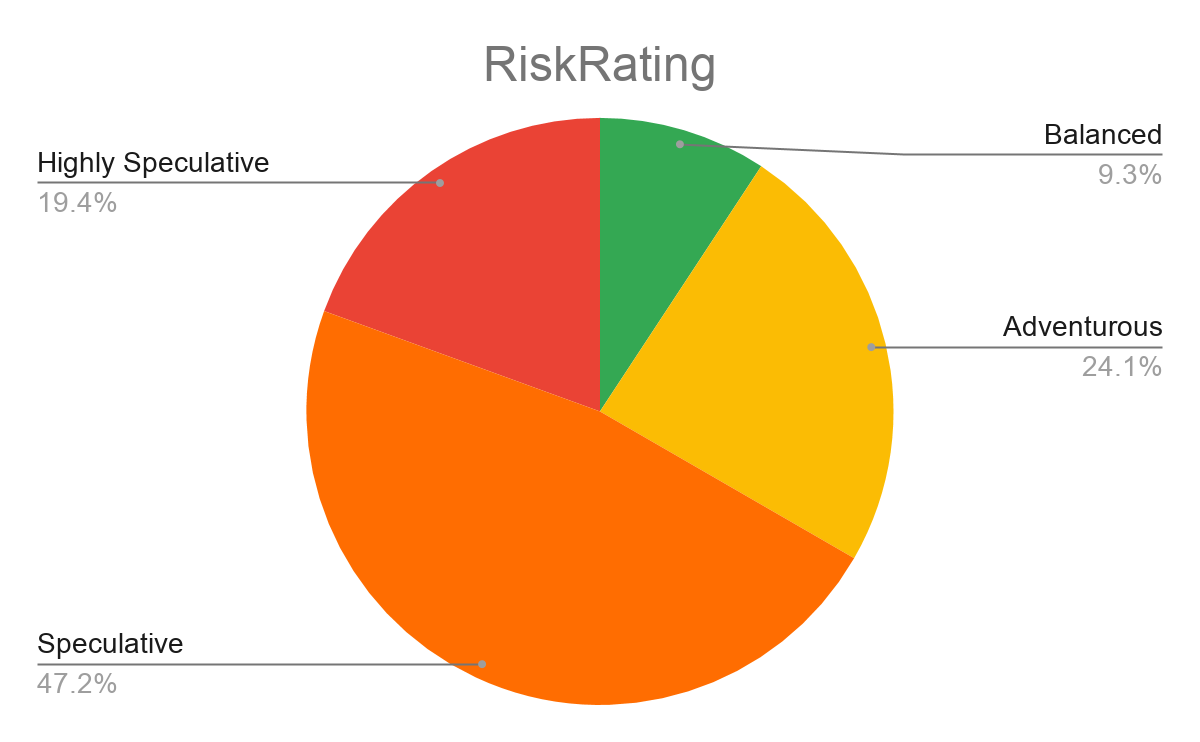

A breakdown of the RiskRatings further confirms that we should tread carefully in this industry. There are high returns to be had, but there is a lot of volatility as well. In fact there are no Conservative stocks, and the large speculative weighting skews the set firmly towards the more volatile end of the market:

It appears as though fortunes can be both made and lost in Software.

Moat or mirage? Refining the sample

That might in part be because it’s so hard to make moats in this sector. The innovation and evolution is so intense that seemingly incredible bits of hardware and software can soon become obsolete. Today’s high margin must-have can be, by tomorrow, just another binned Blackberry.

High profit margins tend to have an expiry date - if you’ve found a good meal hungry rivals will muscle in.

Some companies can defy gravity and maintain high margins for great periods of time though - and it is these companies that go on to create a tremendous amount of value for their stakeholders.

If an economic moat is a durable competitive advantage, we can think of that in two dimensions: there’s depth (how much money the firm can make from its…

.jpg)