Stockopedia contributor Roland Head, recently wrote an article where he built a screen to find quality stocks that are strong compounders. (Building a screen to find Compounding Quality stocks) The idea with this type of stock is to buy and hold. You are not looking for a quick gain, but rather to watch your wealth compound over a long period of time. Warren Buffett has said that when he finds a great business, his favourite holding period is "forever". I took this screen and applied it in the Australasian context. 14 stocks met all of the criteria. One of those stocks was PWR Holdings (ASX:PWH).

PWR is a manufacturer of advanced cooling systems. They have traditionally been focussed on motorsport and are the dominant provider of cooling systems for Formula 1 with all teams using their cooling products. They also work with Supercars, touring cars, rally cars, Nascar and Indycar teams all over the world.

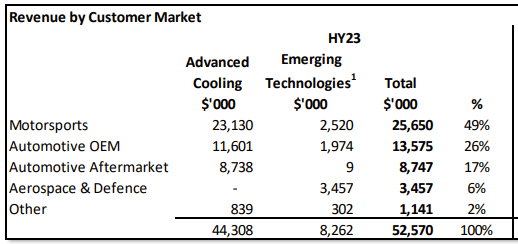

They have gradually been diversifying their revenue sources. More than half their revenue now comes from outside motorsport.

Original Equipment Manufacturers (OEM) are now the second largest revenue generator for the business. This involves the supply of cooling systems for high performance vehicles such as the new AMG X1 and Ford Mustang GT500. They are also pushing into the electric vehicle market. EV’s have sophisticated cooling requirements. PWR is now involved in seven different EV manufacturing programs. To improve their access to the big EV manufacturers in the UK and Europe they have been making acquisitions and building a significant manufacturing facility in the UK.

Perhaps surprisingly for a family business started on the Gold Coast in 1987, the majority of revenue is now generated overseas. Their biggest markets are the USA, followed by the UK, Italy and then Australia.

So why do they make the quality compounders screen?

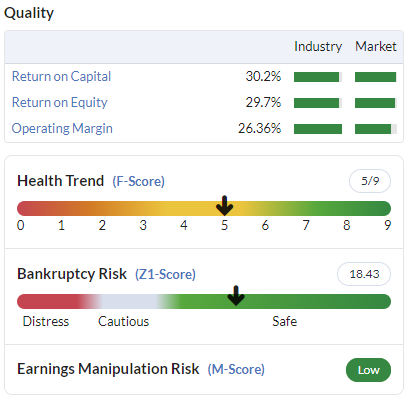

The first criteria the screen focuses on is, unsurprisingly, quality, specifically a QualityRank of over 80. PWR easily qualifies here with a quality score of 92.

Next the screen focuses on profitability. A number of measures are used here. The first is return on capital employed (ROCE). In the long term, a company’s growth rate will be limited by the returns it can generate on its capital. Roland uses a threshold of 18%…