Righto, another quarter’s done, time to check in on performance again. First, my Q1 and H1 performance reviews will provide you with some handy background & context. Second, it’s always fun to pose some questions before hitting the stats:

- Of the US/Europe/UK/Ireland, which do you think has had the worst year to date?

- And the best?

- So, did you predict your best stock winner year to date?

- Ever notice how much easier it is to predict your worst stock loser?

- Is there any lesson, or story, attached to your losses?

- Why has the average hedge fund under-performed so badly this year?

Well, hopefully I cover some/all of those questions here..!

Some notes: For simplicity, an equal weighting’s assumed for all stocks. No attempt’s made to calculate FX gains/losses either – depends on your base currency anyway! Base prices are either yr-end 2011 prices (for stocks written up in ’11), or the price noted when I did my 2012 writeup. If a stock has been subsequently sold (marked**), the price noted when I reported the sale (via blog post, comment and/or tweet) is used. So, without further ado, here’s my complete Q3 2012 YTD performance:

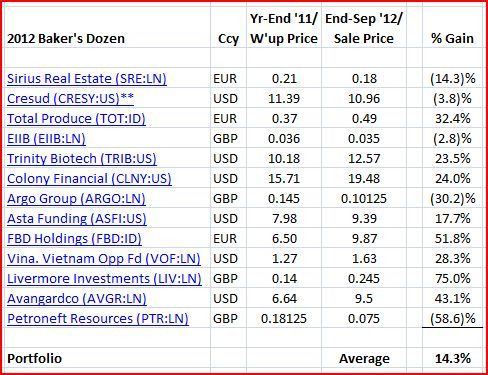

And it’s a one-two punch – here’s the performance of my 2012 Baker’s Dozen (pretty much a subset of the above):

And how about the indices, by comparison?

If only it was year-end, it might be a Hamlet moment... Hmm, then again, year-end is just another day when it comes to investments. But I’m delighted with an absolute return performance of +10.9% and +14.3%. Even better, that represents an out-performance of +1.6% and +5.0% vs. the indices!

But, like every despicable charade of a performance appraisal one’s ever endured, let’s quickly switch to what’s holding me back. Much the same as last time, actually, young Gr-Granville:

Sector: My Baker’s Dozen benefits again from a lighter weighting in resource stocks (inc. Russia in that definition). In fact, overall, inflation plays (if I also include real estate) are the main detractor – sorry, should say the main source of f**king pain. It wasn’t how I arrived at my conclusion, but it’s pretty bloody intriguing to see inflation plays perform so poorly in…