"One disadvantage of asset purchases relative to conventional monetary policy is that we have much less experience in judging the economic effects of this policy instrument, which makes it challenging to determine the appropriate quantity and pace of purchases and to communicate this policy response to the public."

- Federal Reserve chairman Ben Bernanke, referring to quantitative easing.

Or to put it another way: we don?t know if it will work, and we don?t know how to spin it. These are dismal days. Having exhausted conventional monetary policy, the Federal Reserve is busily exercising its two remaining options: clutching at straws, and pushing on strings. The ultimate outcome from QE2 remains to be seen. In the short term, though, stock markets and indeed most other financial assets have reacted in classic Pavlovian fashion: ring the dinner bell announcing fresh liquidity, and they will rally in response. This should give equity investors pause. Assuming some correlation between economic growth and market return, the announcement of general desperation on the part of the central bank does not equate to a favourable fundamental backdrop for investors. Rather, it merely perpetuates a general euphoria sponsored by liquidity provision and nothing else. The advice for equity market investors must remain: enjoy the party, but dance near the door.

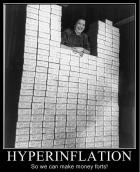

Things are bad enough for the US. QE2 is really a slap in the face for a US electorate that has just loudly rejected further fiscal stimulus – but then the Federal Reserve is not a conventional diplomatically elected body so much as a private banking clique driven by discredited economists (other than the Austrian school, is there any other type ?). Perhaps the purchase of a few more hundred billion Treasuries will turn around an economy stuck with softening house prices, rising foreclosures and deleveraging households. But the Federal Reserve is not trying to manipulate a market and economy in a closed system; the US is not an island. The impact beyond its shores is unsettling, notably for foreign investors whose appetite for holding ever depreciating dollars cannot be taken for granted. This point has been acknowledged by the international chorus of disapproval that has greeted confirmation of QE2, for example in the comment by Wolfgang Schäuble, German finance minister, that Americans accusing the Chinese of exchange rate manipulation were being inconsistent while themselves steering the dollar lower through money printing. The…