2014 was a year to forget for many of the 60 investing strategies inspired by the legends of finance that are tracked by Stockopedia. With the UK's main indexes generally drifting lower last year, weak sentiment and missed earnings targets hurt performances across the board. But the first three months of 2015 have witnessed a change of fortune for the gurus. Along with a general uptrend in the market, some of these strategies are flying.

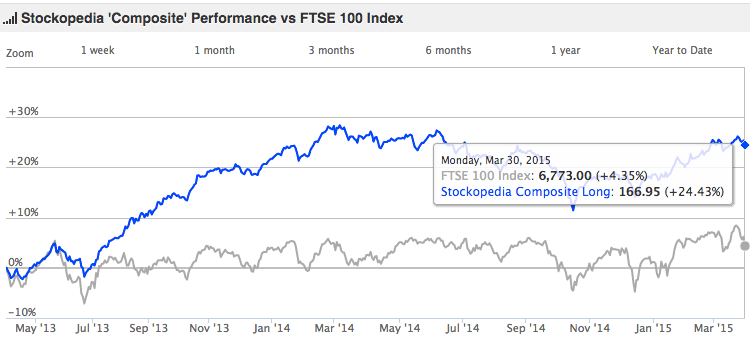

Overall, the Stockopedia Composite Long index - which aggregates the performance of all the guru strategies - rose by 4.9% during the first quarter. That was broadly in line with the market. Over the past 24 months the Composite is up by 24.4%.

Index / Strategy Composite | Performance Q1 2015 |

3.2% | |

6.2% | |

3.7% | |

5.6% | |

2.0% | |

4.8% | |

7.9% | |

Guru Strategy Composite | 4.9% |

5.4% | |

4.2% | |

7.0% | |

4.0% | |

8.0% | |

-2.3% |

During the quarter Stockopedia launched the new StockRanks portal. StockRanks score and rank every company in the market according to their Quality, Value and Momentum characteristics. In the first three months of the year, stocks with a market cap of at least £10 million and StockRanks in the top 10% of the market produced a return of 7.9%.

Top performing strategies

Overall it was Quality strategies that produced the highest returns during the quarter, at 8.0%. The Warren Buffett - Hagstrom screen produced a 19% return, albeit from just three stocks (the newly rebalanced portfolio comprises eight stocks going into Q2). Echoing the generally improved performance of the gurus in 2015, the Screen of Screens bounced back with a 14.4% return. Any stock can qualify for the SoS as long as it…