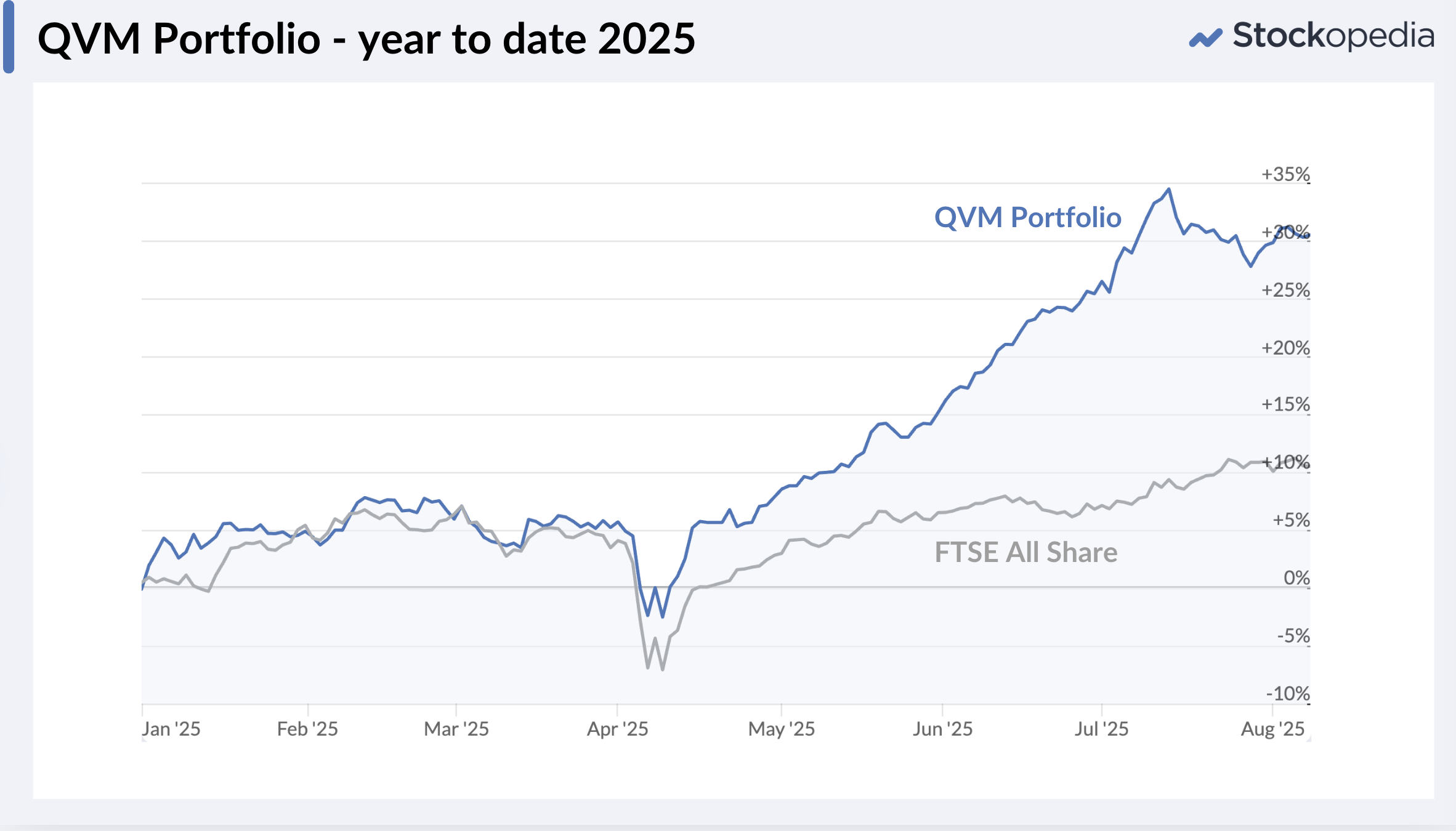

It’s been a stunning year so far for the QVM Portfolio, which has returned 31% before dividends. It's even tracking 4% ahead of the NAPS Portfolio, which began with the same holdings.

The only difference between them is that when Alliance Pharma received a takeover bid, the QVM Portfolio reinvested it in the next highest-ranked Healthcare stock - SDI (LON:SDI) - while the NAPS sat on the cash.

That turned out to be a fortuitous decision.

Since January 15th, SDI (LON:SDI) has gained 64%. But it's position size was larger than usual as I'd rolled Alliance Pharma's 33% gain into the position. So, this hybrid Healthcare holding has combined to return a 118% gain on the original stake.

Beyond this, the junior gold mining positions of Metals Exploration (LON:MTL) and Serabi Gold (LON:SRB) have contributed +160% and +89%, while Seplat Energy (LON:SEPL), Journeo (LON:JNEO) and M P Evans (LON:MPE) have all added 30-40%. It’s shaping up to be a strong year.

Another bid - should we rinse and repeat?

We can’t expect every reinvestment to work out as well as SDI, but on the 30th July, International Personal Finance (LON:IPF) received a ”possible recommended cash offer”.

The share price popped up 18% on the news. The bid is mooted at 220p per share should it go ahead - which is 4.7% above the current share price.

Now, this creates a bit of a quandary. It’s not officially a recommended offer. It’s “possible”. Could another suitor come out from the wings? Could the deal fall through? If it does, the shares might pull back, but the company is trading well and there's good momentum. It’s also one of Graham’s most bullish ideas - he owns it himself and thinks the bid is too low.

Nonetheless, one of my rules for the QVM is to sell on a recommended takeover bid.

But it’s not recommended yet. According to the takeover rules, the bidder has until the 27th August to confirm its intention.

If the bid goes through, it will probably complete October or November. There’s a 4.7% gain baked in if we wait, plus another 3% from a dividend if we hold past the 28th August ex-dividend date.

So while fortune favours…

.JPG)