Reckitt Benckiser shows that the best investment opportunities can be right under our nose. Nineteen “Powerbrands” generated 80% of net revenue in 2014 and include names like Finish, Cillit Bang and Nurofen. With strong market positions and attractive margins the company has kept investors in good health.

According to research in “What Works on Wall Street” (2012, P545) the best performing long-term sector has been consumer staples. This area encompasses Tobacco, Beverages, Food and Home & Personal Care.

Consumer staples feature low cost, every-day products that tend to see demand hold up when economic conditions are weak. Companies in the sector usually own strong brands that have withstood the test of time.

Challenges include supermarket own brand competition, changing consumer tastes, regulation, tax and weak growth. These issues have, though, generally been less harmful than the headwinds facing sectors such as banking.

Consumer staple companies have been able to retain and compound value over the long-term. This is in contrast to sectors that deploy significant financial leverage, see leadership positions change and face cyclical demand.

Reckitt Benckiser’s Powerbrands

Source: Reckitt Benckiser website

FTSE 100 consumer staple groups include Imperial Tobacco, British American Tobacco and the alcoholic drinks giants SAB Miller and Diageo. The two remaining FTSE 100 consumer staple groups are Reckitt Benckiser and Unilever.

All six firms have generated significant shareholder value over the long-term and as such merit investor consideration. However, tobacco and beverage companies are potentially at risk from changing tastes, taxes and regulations.

This leaves Reckitt Benckiser and Unilever as arguably the least risky consumer staple companies in the FTSE 100. Both face the challenge of supermarket own brand competition but have managed to hold their own.

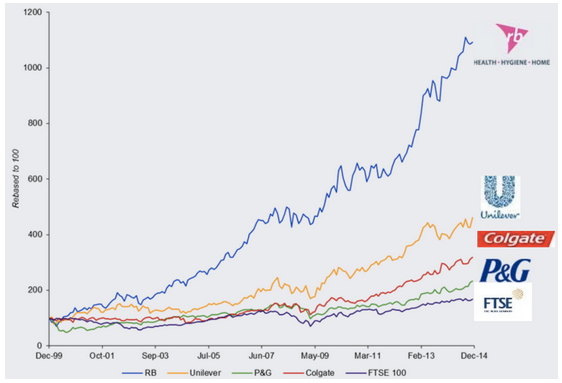

Looking at Reckitt Benckiser more closely and the long-term share price performance has been spectacular. With the forecast P/E rating for 2016 at 22X the issue now is whether it is worth getting on board.

Reckitt Benckiser has outperformed its peer group

Source: Reckitt Benckiser investor fact sheet

Reckitt Benckiser’s Powerbrands

Reckitt Benckiser has 19 “Powerbrands” which generated 80% of revenue in 2014. The two main divisions are Health at 31% of 2014 revenue and Hygiene at 41% of revenue while Home came in at 20% and Foods at only 4%.

The strategy of Reckitt Benckiser is to focus on higher and higher margin divisions of…