Hello everyone.

Too often we find a red warning saying that "Altman Z-Score Screen" was triggered for a security we are interested in. Indeed, around 45% of non-financial shares have a Z-Score lower than 1.8: but a warning that pops up half of the time is not a very useful warning. So, to say that a company with a Z-score of less than 1.8 is very likely to go bankrupt within the year is like to say that the female half of the population (from 0 to 100+ years old) has a good chance of giving birth to a child within the year. In conclusion, to stay in the maternity metaphor, using Z-Score like this you really risk throwing the baby out with bathwater.

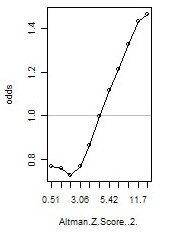

I believe that the problem derives from the fact of using fixed values in a theoretically still valid model. Perhaps certain values were perfect in 1968, but today they no longer work so well. That's why I worked out my personal version of the Altman screen: only 10% worse for Z-Score in the same industry. In this way the warning is triggered only for about 3-4% of non financial companies. This seems to me to be more reasonable, given that listed companies that go bankrupt every year are usually a smaller percentage. In 2018 there were only 58 bankruptcies over thousands of american public companies.

What do you think?