John D. Rockefeller famously said, “Do you know the only thing that gives me pleasure? It's to see my dividends coming in.” For Rockefeller, dividends weren’t just a side benefit—they were a core part of his investment income. At times, nearly two-thirds of Standard Oil’s profits were paid out as dividends. Furthermore, some estimates suggest that Standard Oil once accounted for about 2% of the entire U.S. GDP. It’s easy to see why the saying goes, “rich as a Rockefeller.”

While dividend payouts have declined from the lofty heights of the Rockefeller-era, their appeal remains unchanged. Dividends provide investors with tangible cash returns. They can also signal a company’s financial health and stability. That’s why knowing which companies are paying dividends—and when—is essential information for any investor. With this in mind, we have introduced various features to help users find dividend dates quickly and easily.

We are also pleased to introduce a few further modifications to our News feed — the Stockopedia portal for finding, reading and assessing the impact of daily company news announcements. These build on our prior release and include simple bug fixes as well as more meaningful changes which we hope will help the way you use the feature.

As always, feedback and product suggestions are welcome in the comments below…

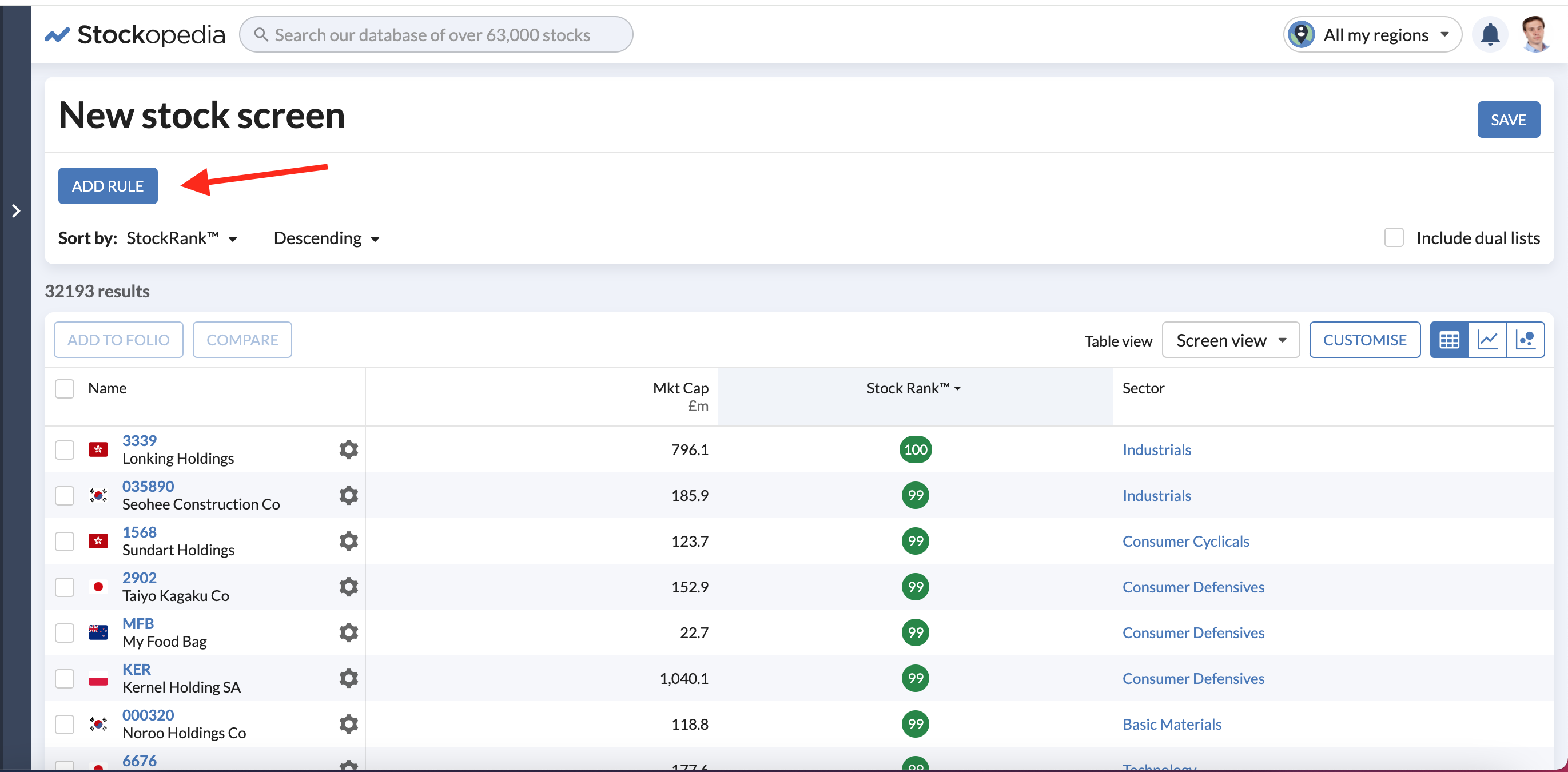

New screener functionality

We’ve enhanced the screener so you can filter stocks by dividend dates. It is possible to screen using ex-dates and payment dates (upcoming and historic).

- Start by clicking ‘Add Rule’.

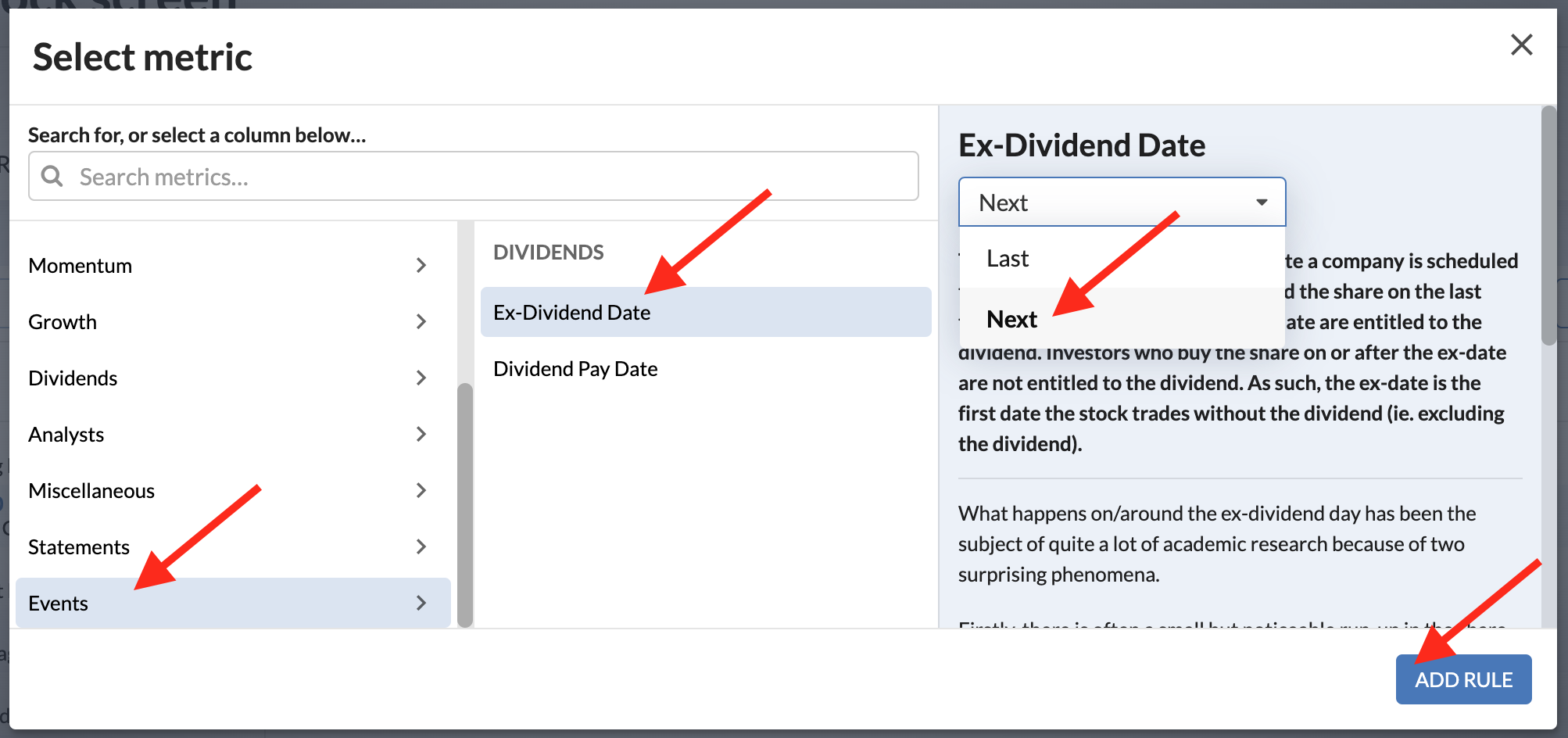

- A modal popup box will appear, displaying dividend dates under the ‘Events’ section (see below-left).

- You can choose Last to view historic dividends, or Next to see upcoming dividends.

- Click the ‘Add rule’ button (see below-right).

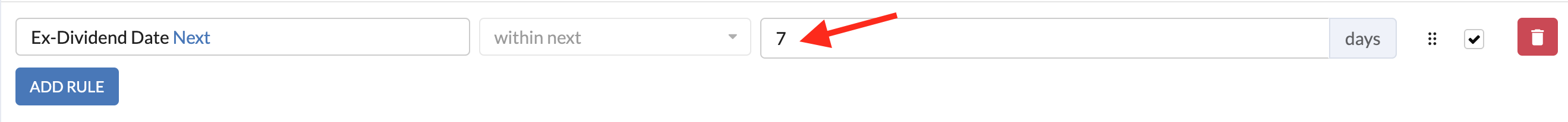

- The ‘days’ input box lets you set the timeframe. In this context, ‘days’ pertains to calendar days, not trading days.

Review dividend dates alongside key financial ratios

Many investors will want to track dividend dates alongside other dividend-related data points, such as yield, dividend cover, and dividend growth. You can do this by customising your portfolio tables to include columns for key dividend dates.

Unlock the rest of this article with a 14 day trial

Already have an account?

Login here