Yesterday, I discussed the robust start to the financial year for the retail sector and also highlighted the significant challenges that the sector is facing. As mentioned, we have a fairly positive view that these challenges will only be short term hurdles, and that the higher quality retail businesses will be able to overcome them.

In today’s instalment, I will discuss the remaining stocks from the list below including the key drivers of their performance. (If you missed Part 1 of this series you can read it here)

And remember, these companies appear in no particular order.

ASX: AX1 Accent Group. QVM StockRank score 91

Distributor and retailer of shoes and leisure wear, AX1 just makes it above 90 on the QVM StockRank table on account the quality of its earnings doing much of the heavy lifting.

AX1 has now put the drop in profitability and margins of the COVID years, behind them. Thus far for the first 18 weeks of FY23, total Group owned sales are up 52% compared to FY22 with margins significantly improving as well. With 50 new stores due to open in 1H23, we expect a return to a growth trajectory.

As another interesting aside Brett Blundy continues to be a significant investor in the firm and recently lifted his holding in AX1 to just below 20% when he made a large on market purchase earlier this year. Such a move has provided confidence to the market.

ASX:UNI Universal Store Holdings. QVM StockRank score 96

Similar to AX1, UNI are a leisure wear fashion retailer that has proven incredibly resilient in the face of rising cost pressures.

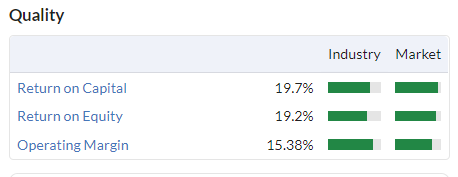

Quality earnings underpin this retailer, who only saw sales fall 1.4% last period in the face of COVID lockdowns. This resulted in a fall in profitability and margins. Though pleasingly, it could have been worse, with margins only slightly falling. Cashflow is strong, both ROE and ROC are at high levels relative to peers and the dividend has remained stable with hopes that this will be lifted next year.

The company is embarking on a strong store rollout plan with 11 new stores opening last year and it has a target of target is 100+ Universal Store …