Given the prevailing macro conditions of quantitative easing and low to negative interest rates, it’s reasonable to assume the past decade has seen more than its fair share of poor capital allocation. When the cost of borrowing is pushed down, projects that would not be economically feasible under “normal” conditions can all of a sudden be given the green light.

Warren Buffett once said: you only find out who is swimming naked when the tide goes out. I think there’s probably more than a couple of skinny dippers out there right now.

For all its bargepole companies and financial scandals, the AIM market is actually a particularly healthy index for small caps. On a market-weighted basis, around three-quarters of its companies are profitable and cash generative and about two-thirds are dividend-paying. Because of this quality, AIM could prove to be quite resilient in the years ahead. It’s a good pond to fish in.

Two of the most promising prospects on AIM are top Quality-Momentum stocks Judges Scientific (LON:JDG) and Sdi (LON:SDI), although some have concerns over their premium valuations. The two companies are similar “buy and build” operators consolidating high margin companies in long term growth markets. They look expensive right now, but they also looked expensive when we wrote about them last October. Since then the Judges share price has increased by 30% (40% at one point earlier in January) and the SDI share price has risen by 55% to 92p.

There has been news flow to power these performances (as well as generally strong market conditions). Both have released news in the intervening weeks and months, so I thought I would revisit them.

(please note: I have small positions in both of these companies)

Judges Scientific: market beats and ‘mini-mes’

Forecast PE ratio: 25.6

Market cap: £343.54m

QM Rank: 99

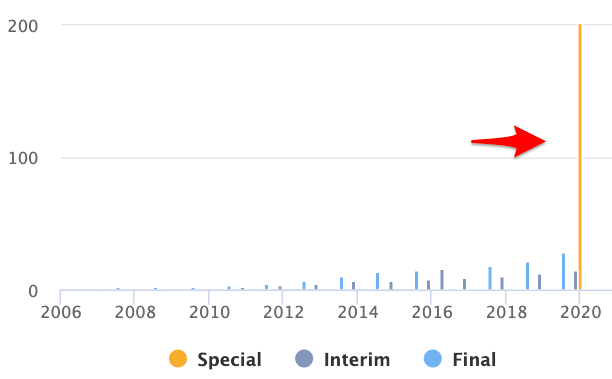

One of the most attractive aspects of Judges Scientific is its shareholder-friendly culture. An example of this came in late November when the group decided that, “in order to prioritise the interests of its shareholders”, it would pay out a one-off special dividend of 200p per share. This is equivalent to about 3.7% of today’s share price.

Following this payment, the Group will have returned to shareholders four and a half times the IPO price. You can see that it dwarfs previous payments to shareholders:

.jpg)