Revolution Bars (RBG): a classic GARP stock?

Now this is admittedly not my normal type of stock, as I am usually wary bar and restaurant stocks given their typical need for high capital spending and low consequent returns on capital.

Revolution Bars (LON:RBG) seems to be an exception to this rule, despite the fact that it typically spends £2m per new bar.

Profitability is strong, with 76% gross margin and 13% EBITDA margin, thanks in part to running costs that seem admirably low at just over 40% for payroll + rents combined.

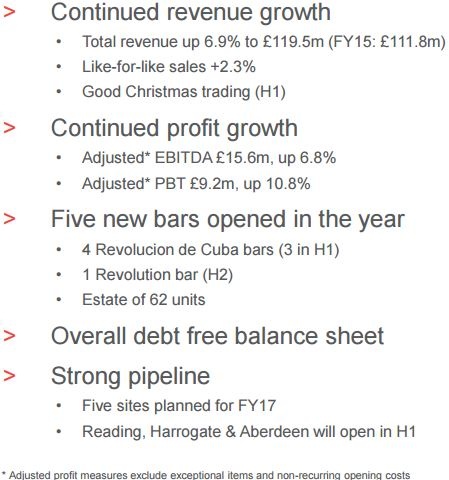

Growth is decent, with 62 bars open today (+5 over the last fiscal year) and +2.3% like-for-like sales growth on average within each bar. 5 more sites are planned for the coming year, mostly in university towns with lots of students and young professionals (the key catchment population).

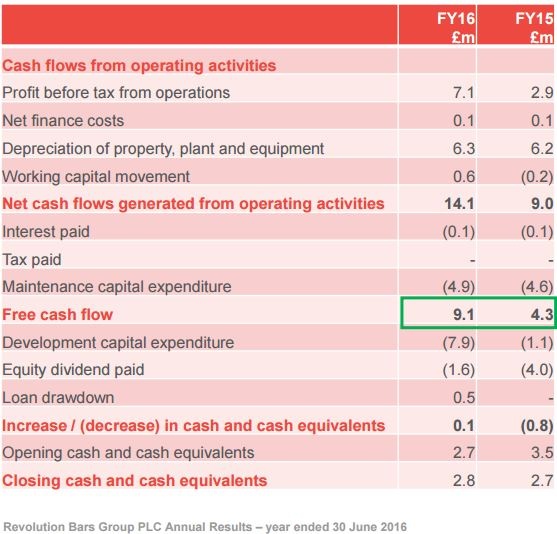

Net free cash flow is not huge, but that is to be expected when Revolution Bars (LON:RBG) are spending consistently on rolling out new bars (annual £10m approx. cash flow cost), but note that this rollout is at least being funded from internal sources rather than via increased debt or equity capital.The balance sheet has a modest amount of net cash, so no financial gearing to worry about unlike your typical pub group.

According to RBG's recent results presentation, net free cash flow (ex expansion capex) is around 11%!

Valuation is attractive at 9.8x forward P/E and under 5x FY2017e EV/EBITDA. And a 3.3% dividend yield is to be paid too.

Finally, the chart looks appealing given the sharp run-up over the last few days, with further recovery potential ahead. Note that the consensus broker target is +47% above current levels.

Overall then, an attractive GARP stock to look at in my view, but of course, please Do Your Own Research!

Edmund